Stewardship

Dear Stakeholders,

We are committed to ensuring that the Bank and Group operates at the highest standard of corporate governance. We believe the Board is the Custodian of the Bank’s performance and behaviours and sets the vision, strategic aims and values to which the entire Group must adhere.

Our Corporate Governance practices are built on making a positive and sustainable impact in the lives of our customers, suppliers, employees, communities and on the environment in which we operate. This underpins a strong and sustainable business for our shareholders, while creating societal value for our stakeholders.

We are committed to and focused on leveraging our vision, culture and governance practices to deliver successful customer experiences, engage with our employees, mitigate our risks, identify new opportunities and enhance our reputation. We believe this will help us meet our objectives of delivering superior shareholder returns and being the driving force for a financially empowered Sri Lanka.

It is with great pleasure that we present the Corporate Governance Report for 2015 which elaborates how the Board, its Committees and The Leadership Team effectively and collaboratively achieved these goals.

During 2015, the Bank took steps to readjust its mission, vision and values to better suit the long-term objectives of the Bank. We have described the initiatives taken by the Bank in this regard in greater detail below.

We are fortunate to be supported by a Board that possesses a diverse set of skills. During 2015, we continued to take a forward looking approach to refreshing our Board composition. The Board has always maintained fairness, responsibility, accountability and transparency for the betterment of its stakeholders. It is accepted that the effectiveness of a Board depends on its individual members. Each member of the Board brings a different area of expertise, skills and experience to the table which encourages a robust exchange of alternate views and ways of thinking. The Board staunchly supports The Leadership Team that runs the day-to-day business operations of the Bank by giving them guidance in executing our agreed strategy.

We would like to thank Sunil Wijesinghe our previous Chairman, Ms. Chandra Ekanayake, Sujeewa Rajapakse and Anura Siriwardena all of whom resigned in March 2015, for their unstinting support and assistance towards the Bank and Group and their contribution on the Board and Board Committees.

Statement of Compliance

The Bank’s Corporate Governance Report for 2015 highlights important elements of the governance framework that is in place at National Development Bank PLC and the Bank’s adherence to the requirements set out in the Corporate Governance Direction issued by the Central Bank of Sri Lanka (CBSL) and the Code of Best Practice on Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka (ICASL) and the Securities and Exchange Commission of Sri Lanka (SEC) (the Code). The Report also covers the Factual Findings Report submitted by External Auditors in relation to compliance with the Corporate Governance Directions issued by CBSL.

As required by the Code, we hereby confirm that, we are not aware of any material violations of any of the provisions of the Code of Business Conduct and Ethics (as embodied in the Internal Code of Corporate Governance applicable to Directors and Key Management Personnel of the Bank as the case may be) by any Director or Key Management Personnel of the Bank.

N G Wickremeratne

Chairman

Mrs. K Fernando

Chairperson

Corporate Governance and Legal Affairs Committee

12 February 2016

Colombo

Corporate Governance Initiatives of the Bank for the Year 2015

- Launched a new vision and mission statement in alignment with the new strategic objectives of the Bank.

- Refreshed the Bank’s core values which were communicated to all employees through a brand playbook that provided them with a better understanding of the Bank’s corporate philosophy. The playbook contained inspirational stories of real life heroes that lived each value.

- Established a Related Party Transactions Review Committee: Further to the directive issued by the SEC to adopt the Code of Best Practice on Related Party Transactions for listed companies mandatorily by 1 January 2016, the Bank opted to voluntarily adopt same with effect from 1 January 2015.

- The Board, all Board Committees and all Management Committees carried out self-assessments to critically evaluate the effectiveness of the Board and each of the Committees. The results of the self-evaluations were discussed in detail and areas for improvements together with an action plan were mandated.

- All policies, procedures and product programme guides are tracked on a monthly basis to ensure that they are reviewed in a timely manner and are up to date and in compliance with laws, regulations and internal operational standards.

- All documents pertaining to Board meetings were made available in electronic format to enable timely, more efficient and interactive real time communication among Board members in line with sustainability initiatives adopted by the Bank to reduce paper usage.

- Explanatory Notes and E-Flyers were circulated to Employees to provide a simplified understanding of new regulations applicable to the Bank's business.

|

Our Stakeholders

We believe that, in order to be effective, we should demonstrate ethical leadership and promote the Bank’s collective Vision, Mission and Values.

Therefore, the Board is committed to act in a way they consider, in good faith, would promote the success of the Bank for the benefit of all its stakeholders and, in doing so, have regard (amongst other matters) to the:

- likely consequences of any decision in the long-term;

- interests of the Bank’s employees;

- need to foster business relationships with the Bank’s suppliers, customers and others;

- impact of the Bank’s operations on the community and the environment;

- desirability of the Bank maintaining a reputation for high standards of business conduct; and

- need to act fairly as between stakeholders of the Bank.

We are responsible for ensuring that management maintains a system of internal control which provides assurance of effective and efficient operations, internal financial controls and compliance with laws and regulations. In addition, we are responsible for ensuring that management maintains an effective risk management and oversight process at the highest level across the Bank and Group.

The diagram below depicts the structures, processes and relationships in place that contributes towards the Corporate Governance culture of the Bank.

|

Our Corporate Governance Framework

The Bank has a well-defined and well-structured corporate governance framework in place to support the Board’s aim of achieving long-term and sustainable value for all its stakeholders.

Some of the components include:

- A highly skilled, diverse and independent Board

- Strong co-ordinated management

- Robust risk management systems

- Compliance with external regulations and internal policies

- Timely comprehensive communication with stakeholders

- Long-term genuine commitment to sustainability

Authority is delegated by the Board to the Chief Executive Officer (CEO), who is responsible for the management of the Bank’s diverse businesses. The CEO further delegates authority to The Leadership Team and management committees who are empowered to make decisions to specified levels, beyond which they are escalated to the CEO or Board (as prescribed by the Board). There is in place a clear and consistent top-down governance structure across the Bank, aligned to personal accountabilities and delegated authorities. The governance framework and specific delegations are reviewed by the Board and CEO regularly.

The Governance structure of the Bank is represented below:

|

Effective Leadership by the Board

Board Process

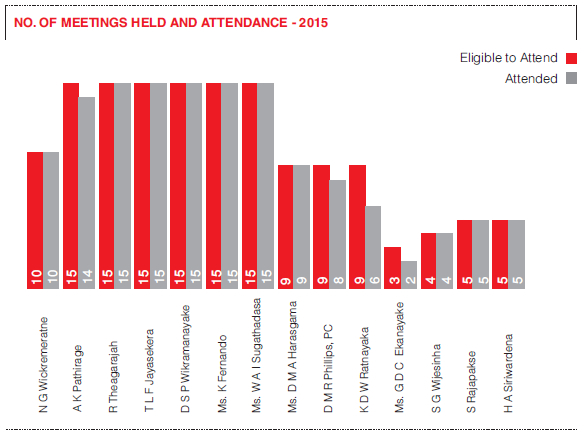

The Board recognizes the importance of providing timely and appropriate information to Directors so as to enable them to make informed decisions and to perform their duties and responsibilities effectively. The Board met fifteen times in 2015.

|

The Role of the Board

The Board of Directors as the highest governing body of the Bank plays a central role in defining our long-term strategy, performance goals and Corporate Governance standards. The diagram below details key areas of focus by the Board during the year. Please refer these tables for more details relating to processes implemented by the Board in these areas for 2015.

|

Board Composition

The Board consisted of ten Directors as at end December 2015, from whom nine including the Chairman are Non-Executive Directors. Of the nine Non-Executive Directors, six are Independent Directors. The Chief Executive Officer of the Bank, functions as the only ex officio Director.

The Board reviews its composition and is committed to ensuring diversity and inclusiveness in its composition and deliberations. It embraces the proposition that having a diverse Board would have a positive, value-relevant impact on the Bank. In this regard, the Board considers diversity from a number of different aspects, including gender, age, cultural and educational background, ethnicity, professional experience, skills and knowledge that are directly relevant to our businesses. The Nominations Committee of the Board recommends the filling of vacancies of Directors based on the guidelines approved by the Board and ensures that all Directors are persons of integrity and repute with creditable track records. The four new Directors who joined the Board in 2015 have brought with them fresh insights and knowledge from the areas of Information Technology, Law and Finance.

The structure and composition of the Board as at 31 December 2015 and the attendance of each Director is set out in the table below:

| Name of Director | Areas of Expertise | Independent/Non-Independent Under Cbsl Direction | Independent/Non-Independent Under Icasl/Sec Code Direction | Date of Appointment | No. of Board Meetings Held in 2015 | No. of Meetings Attended |

| N G Wickremeratne | Management & Banking | Independent | Independent | 15.04.2015 | 10 | 10 |

| S G Wijesinha (Resigned w.e.f. 27.03.2015) | Engineering, Finance and Management | Independent | Independent | 04.10.2013 | 4 | 4 |

| A K Pathirage (Deputy Chairman) | Management, IT and Business Skills | Non-Independent | Non-Independent | 18.02.2011 | 15 | 14 |

| R Theagarajah (CEO) | Banking, Finance and Management | Non-Independent | Non-Independent | 24.08.2013 | 15 | 15 |

| T L F Jayasekera | Banking and Finance | Independent | Independent | 10.02.2010 | 15 | 15 |

| D S P Wikramanayake | Finance, Insurance and General Management | Non-Independent | Non-Independent | 04.06.2010 | 15 | 15 |

| Mrs. K Fernando | Law, Banking and Management | Independent | Independent | 04.06.2010 | 15 | 15 |

| H A Siriwardena (Resigned w.e.f. 31.03.2015) | Management | Independent | Independent | 04.06.2010 | 5 | 5 |

| Ms. G D C Ekanayake (Resigned w.e.f. 11.03.2015) | Finance, Public Policy and Management | Non-Independent | Independent | 07.02.2011 | 3 | 2 |

| S Rajapakse (Resigned w.e.f. 30.03.2015) | Finance and Management | Non-Independent | Non-Independent | 23.02.2011 | 5 | 5 |

| Mrs. W A I Sugathadasa | Insurance, Capital Markets, Human Resources and Management | Independent | Independent | 04.10.2013 | 15 | 15 |

| D M R Phillips, PC | Law | Independent | Independent | 22.04.2015 | 9 | 8 |

| Mrs. D M A Harasgama | Finance, Public Policy and Management | Non-Independent | Independent | 22.04.2015 | 9 | 9 |

| K D W Ratnayaka | Management and IT | Independent | Independent | 13.05.2015 | 9 | 6 |

Board Committees

The Board is assisted by several mandatory and voluntary Board Committees in carrying out more in-depth oversight in the areas of strategic and operational planning, corporate governance, risk management, compliance, financial planning, integrity of external reporting, succession planning, human resources and remuneration policy.

Reports of each of the Board Committees describing the activities undertaken by them during the year, are set out on the respective committee reports.

The Composition of Board Committees for the year 2015 and the attendance of Directors at Board Committee meetings are detailed below:

Details of Members of the Board Committees as at 31 December 2015

| Name of Committee | Human Resources and Remuneration Committee | Integrated Risk Management Committee | Nominations Committee | Board Audit Committee | Related Party Transactions Review Committee | Corporate Governance and Legal Affairs Committee | Strategic Issues Committee | |||||||

| Name of Director | Status | DOA | Status | DOA | Status | DOA | Status | DOA | Status | DOA | Status | DOA | Status | DOA |

| N G Wickremeratne | C | 15.04.2015 | C | 15.04.2015 | C | 15.04.2015 | ||||||||

| A K Pathirage | M | 01.01.2014 | M | 11.08.2011 | M | 18.02.2011 | ||||||||

| R Theagarajah | M | 01.01.2014 | ||||||||||||

| T F L Jayasekera | M | 10.02.2010 | M | 10.02.2010 | M | 10.02.2010 | C | 10.02.2010 | M | 19.12.2014 | M | 11.08.2011 | ||

| D S P Wikramanayake | C | 22.06.2010 | M | 22.06.2010 | M | 19.12.2014 | M | 22.06.2010 | ||||||

| Mrs. K Fernando | M | 22.06.2010 | M | 30.03.2015 | M | 11.08.2011 | M | 19.12.2014 | C | 22.06.2010 | M | 04.06.2010 | ||

| Mrs. W A I Sugathadasa | C | 01.01.2014 | M | 01.01.2014 | M | 19.12.2014 | M | 14.11.2014 | ||||||

| Mrs. D M A Harasgama | M | 22.04.2015 | M | 22.04.2015 | M | 22.04.2015 | ||||||||

| D M R Phillips, PC | M | 22.04.2015 | M | 22.04.2015 | ||||||||||

| K D W Ratnayaka | M | 13.05.2015 | M | 13.05.2015 | M | 13.05.2015 | ||||||||

| Ms. G D C Ekanayake* | ||||||||||||||

| S G Wijesinha* | ||||||||||||||

| S Rajapakse* | ||||||||||||||

| H A Siriwardena* | ||||||||||||||

DOA – Date of Appointment, Status – C – Chairman/M – Member

Number of Meetings Held and Attendance

| Name of Committee | Human Resources and Remuneration Committee | Integrated Risk Management Committee | Nominations Committee | Board Audit Committee | Related Party Transactions Review Committee | Corporate Governance and Legal Affairs Committee | Strategic Issues Committee | |||||||

| Name of Director | Eligible to Attend | Attended | Eligible to Attend | Attended | Eligible to Attend | Attended | Eligible to Attend | Attended | Eligible to Attend | Attended | Eligible to Attend | Attended | Eligible to Attend | Attended |

| N G Wickremeratne | 3 | 2 | 2 | 1 | 1 | 1 | ||||||||

| A K Pathirage | 4 | 3 | 6 | 6 | 2 | 2 | ||||||||

| R Theagarajah | 5 | 5 | 2 | |||||||||||

| T F L Jayasekera | 4 | 4 | 6 | 6 | 9 | 9 | 3 | 3 | 2 | 2 | ||||

| D S P Wikramanayake | 5 | 5 | 9 | 7 | 3 | 3 | 2 | 1 | ||||||

| Mrs. K Fernando | 4 | 4 | 3 | 3 | 9 | 8 | 3 | 2 | 2 | 2 | 2 | |||

| Mrs. W A I Sugathadasa | 4 | 4 | 9 | 8 | 3 | 3 | 2 | 2 | ||||||

| Mrs. D M A Harasgama | 4 | 3 | 6 | 6 | 2 | 2 | ||||||||

| D M R Phillips, PC | 4 | 2 | 2 | 2 | ||||||||||

| K D W Ratnayaka | 2 | 2 | 5 | 4 | 2 | |||||||||

| Ms. G D C Ekanayake* | 1 | 1 | 2 | 1 | ||||||||||

| S G Wijesinha* | 1 | 1 | 1 | 1 | 3 | 3 | 1 | 1 | 1 | 1 | ||||

| S Rajapakse* | 1 | 1 | 3 | 3 | 2 | 2 | 1 | 1 | 1 | 1 | ||||

| H A Siriwardena* | 1 | 1 | 3 | 2 | 1 | 1 | ||||||||

| Ms. G D C Ekanayake* – Resigned w.e.f. 11 March 2015 | H A Siriwardena* – Resigned w.e.f. 31 March 2015 | D M R Phillips, PC – Appointed w.e.f. 22 April 2015 |

| S G Wijesinha* – Resigned w.e.f. 27 March 2015 | N G Wickremeratne – Appointed w.e.f. 15 April 2015 | K D W Ratnayaka – Appointed w.e.f. 13 May 2015 |

| S Rajapakse* – Resigned w.e.f. 30 March 2015 | Mrs. D M A Harasgama – Appointed w.e.f. 22 April 2015 |

NDB Group is committed to conducting its business professionally and ethically

The Related Party Policy of the Bank governs all transactions that the Bank may enter into with related parties of NDB Group.

Directors’ Remuneration

Directors’ remuneration is set out in the Directors’ Report.

The methodology adopted in determining Director's Remuneration is described in the Human Resources and Remuneration Committee Report.

Directors’ Interests in Shares

Bank’s shares held by the Directors in office during the year, are shown under Investor Relations section.

How the Board Manages Related Party Transactions

The Bank and Group are committed to conducting its businesses professionally and ethically. The Board appointed a Related Party Transactions Review Committee mandated to evaluate and consider all transactions that require approval. The transactions are reviewed by the Related Party Transactions Review Committee in line with the Bank’s Related Party Policy. The Related Party Policy of the Bank was approved by the Board in January 2015 incorporating processes to ensure compliance with laws and regulations in relation to related parties as required under the Corporate Governance Direction issued by CBSL, the Code of Best Practices on related party transactions issued by the Securities and Exchange Commission and Section 9 of the Colombo Stock Exchange Listing Rules.

The Related Party Policy of the Bank governs all transactions that the Bank may enter into with related parties of the Bank and Group in order to ensure that related parties are treated on par with other shareholders and constituents of the Bank.

The ownership of the Related Party Policy of the Bank and Group is with the Related Party Transactions Review Committee which is required to ensure that necessary processes are in place to identify, approve, disclose and monitor Related Party Transactions as detailed in the Related Party Policy.

Please refer the Committee Report of the Related Party Transactions Review Committee.

The Corporate Governance Direction issued by CBSL requires Directors of the Bank to avoid conflicts of interests that may arise in their activities with, and commitments to, other organizations or Directors’ related parties. If a Director of the Bank has a conflict of interest in a matter to be considered by the Board, which the Board has determined to be material, such matters are disclosed and discussed at Board meetings, where Independent Non-Executive Directors who have no material interest in the transaction, are present. Further, Directors abstain from voting on any Board resolution in respect of which they have a material interest. Also their votes are not counted in the quorum for the relevant agenda item at the Board meeting. The Director concerned informs the Chairman that such conflicts of interest exists and excuses himself/herself during the discussion of the relevant agenda item at the Board meeting. The above processes have been incorporated in the Bank’s Internal Code of Corporate Governance which is applicable to all Directors and Key Management Personnel of the Bank.

|

Our Values and Ethics

In 2015, the Board revisited the Vision, Mission and Values of the Bank and realigned them to complement the strategic direction of the Board - that of creating even greater value for all our stakeholders.

Our values statement detailed below defines what we believe in and what we stand for. These are our essential guiding principles that would cut across the way we do business, particularly in instances where the rule book provides us no answers.

|

The Bank’s value proposition from its beginnings as a development bank has been an unflinching commitment to the people of this country, be it someone developing a business or an individual trying to move up in life, or a mega project needing financing. The products and services we offer, the innovations we create, the hard work we do and the value we build every single day, is all in service of them. Our determination is to do all we can to make their dreams come true. Therefore, the new tag line approved by the Board in 2015, Our Commitment. Your Success, reflects this thought.

As a custodian of public funds, the Bank has a responsibility to safeguard its integrity and credibility. It is because of this understanding that the Bank was one of the first local banks to introduce a Compliance Policy and Code of Conduct that will apply to all employees. The Code has been regularly reviewed.

The concepts and documentation outlined in the code are clear and precise in order to ensure that employees of the Bank are conversant with the important principles related to the Bank’s Compliance Policy and Code of Conduct. Great emphasis is given to strengthening the code from time to time, thereby inculcating a strong governance framework across the Bank.

The code is currently being reviewed and aligned with the new vision, mission and values to ensure that the key concepts and principles contained therein reflect the Bank’s long-term strategic objectives.

The Board and Key Management Personnel of the Bank are further governed by the Internal Code of Corporate Governance.

Both these codes stipulate the sound principles that will guide Directors and all employees of the Bank in discharging their duties. These codes require high standards of ethics and conduct and clearly prohibit engaging directly or indirectly in any business activity that competes or is in conflict with the Bank’s interest or the interests of its customers, misuse or abuse of their positions in the Bank for their personal benefit or for the benefit of other persons, the misuse of information for the direct or indirect benefit of themselves or of any other persons.

Our Risk Governance

Maintaining an active focus on risk and compliance underpins how we run our business. We identify and actively manage risks as part of a Group-wide ‘Risk Management Framework’ for which the Board is ultimately responsible. The Integrated Risk Management Committee supports the Board to carry out certain responsibilities within the risk governance framework.

Risk accountability across the three lines of defence are maintained as detailed on this diagram.

For more on our risk governance framework refer Risk Management section.

Our It Governance

Technology Governance forms an integral part of the Bank’s Corporate Governance Framework. Alignment to business objectives, prudent expenditure, compliance, risk management, security, responsible allocation of resources and environmental stewardship are core tenets of the Bank’s IT Governance.

Customers today expect to perform banking at their convenience, anywhere and at any time. Our technology strategy is aligned with our business objectives whereby customers can do their banking through easy to use, agile, stable and secure channels. We ensure shareholder value through prudent capital expenditure and considered allocation of resources. We respect the trust placed in us by our customers and the regulator by our commitment to compliance, risk mitigation and information security.

The IT Governance disciplines at the Bank ensure that the technology investments made by the Bank are appropriate, and result in customer convenience, competitive advantage, and business growth.

A summary of the pillars of IT Governance at the Bank are as follows:

Our People

We are committed to building a work environment where people can make a difference both as individuals and as part of a team.

HR governance is a systematic approach to management that enables the HR function to achieve strategic and operational objectives and thereby business performance outcomes.

We believe that having an established HR Governance Framework will lead to improved productivity and assist the Bank to drive organizational change by creating a culture of engagement through specific initiatives and value where people's skills and competencies are developed. This value creation is supported by simplified HR processes implemented in the Bank. Within this framework the Bank also strives to project itself as an employer of choice with effective recruitment methods which are state of the art.

For more on our Employee-related initiatives see this section.

|

Our Communication with Stakeholders

|

We are committed to maintaining a high level of transparency in all our disclosures so that all of our stakeholders have timely and equal access to information.

We communicate this information in a number of ways including direct written communication, publication of all relevant information on our website and webcasts of significant investor relations meetings and at the Annual General Meeting.

The Bank has an investor relations team that promotes open, transparent, efficient and consistent communications with shareholders, investors and equity analysts. The team commits to proactively providing the investment community all necessary information, data and services in a timely manner, in order to help participants in the investment community better understand the Bank’s strategy, operations and new developments.

This Report provides a comprehensive report on the Group’s operations and financial performance for the year under review. It provides full disclosure and is in compliance with the relevant regulations to ensure greater transparency. The Annual Report is printed together with a digital version in CD-ROM format. An online version of the Annual Report is also available on the Bank’s corporate website.

The Chairman together with the CEO ensures effective communication with shareholders. The Chairman apprises members of the Board of the views of investors and other key stakeholders. The Bank’s engagement with shareholders has been disclosed in greater detail in the Investor Relations Report. Further, individual shareholders have access to the Company Secretary and can raise matters relating to their shareholdings and the business of the Bank at any time.

The Bank has in place an effective Disclosure Policy that is dedicated to providing all its stakeholders with timely, accurate and relevant information which would enable stakeholders to make an accurate assessment of the Bank’s activities, performance and risk profile. At the same time, the Bank ensures that confidentiality is strictly maintained in respect of material confidential information which is not publicly available of the Bank’s as well as its customers and stakeholders.

In order to encourage engagement with the Bank’s customers and stakeholders the Bank has in place a Customer Charter, a formal Complaint Handling Procedure supported by an effective MIS system that has been developed internally by our IT Department and a formal Communications Policy.

Governance in our Subsidiaries

The Bank has a governance framework for all our subsidiaries to ensure consistent standards are achieved. All governance related policies including the Compliance Policy and Code of Conduct, Related Party Policy, Securities Trading Policy, Anti-Bribery and Corruption Policies and Gift Policies approved and adopted by subsidiary boards are in line with the policies of the Bank. Corporate governance developments in the subsidiaries of the Bank are monitored on an ongoing basis to ensure that legal and regulatory requirements are met. The Bank’s Compliance Function continues to work with subsidiaries on embedding and improving their corporate governance framework.

The Bank’s compliance with the Banking Act Direction No. 11 of 2007 (as amended) on Corporate Governance issued by the Monetary Board of the Central Bank of Sri Lanka, is detailed below with explanatory comments as follows:

| Rule No. | Corporate Governance Principles | Compliance Status | Compliance and Implementation in 2015 | ||||||||||||

3 (1) |

Responsibilities of the Board |

|

|

||||||||||||

3 (1) (i) |

The Board shall strengthen the safety and soundness of the Bank by ensuring the implementation of the following: |

||||||||||||||

(a) Approve and oversee the Bank’s strategic objectives and corporate values and ensure that these are communicated throughout the Bank; |

Complied |

The Bank’s strategic objectives and corporate values were revised and updated in 2015, to be aligned with the Bank’s current business strategy. The new objectives and values were approved by the Board in July 2015 and communicated to all members of the staff at communications meetings, via e-mails, through the Bank’s intranet ‘NDB Cloud’ and a brand playbook. In addition, communication is further enhanced through corporate branding of the premises with the new Corporate Values, Mission and Vision of the Bank. |

|||||||||||||

(b) Approve the overall business strategy of the Bank, including the overall risk policy and risk management procedures and mechanisms with measurable goals, for at least the next three years; |

Complied |

The Bank’s overall business strategy was approved by the Board for a period of five years viz 2014 – 2018. An overall Risk Management Framework consisting of policies and procedures, have been approved as required by the Direction. |

|||||||||||||

(c) Identify the principal risks and ensure implementation of appropriate systems to manage risks prudently; |

Complied |

The Board is responsible for the overall risk framework of the Bank. Board members discuss at length new strategies of the Bank, any potential risks arising from them and the risk mitigation strategies. The Integrated Risk Management Committee (IRMC) appointed by the Board, reviews and recommends to the Board, the Bank’s Risk Policies and procedures defining the Bank’s risk appetite, identifying principle risks, setting governance structures and implementing policies and systems to measure, monitor and manage the principal risks of the Bank. The Board has approved risk management policies and procedures as reviewed and recommended by the IRMC, based on these parameters and as required by this Direction. |

|||||||||||||

The following reports provide further insights in this regard. |

|||||||||||||||

(d) Approve implementation of a policy of communication with all stakeholders, including depositors, creditors, shareholders and borrowers; |

Complied |

The Bank has in place, a Board approved Communications Policy aimed at encouraging effective internal and external communications of corporate information, covering all stakeholders including staff, customers, creditors, shareholders, partners, general public and regulators. The Communications Policy has been communicated to all staff and is published in the Bank’s intranet ‘NDB Cloud’. |

|||||||||||||

Communications with stakeholders takes place through the following mechanisms:

|

|||||||||||||||

|

|||||||||||||||

(e) Review the adequacy and the integrity of the Bank’s internal control systems and management information systems; |

Complied |

The Bank has a stringent process in place to determine the accuracy of the financial information provided to the Board and the effectiveness of internal controls on financial reporting. |

|||||||||||||

The Bank has in place a Management Information Systems Policy, approved by the Board. In this policy, all financial and non-financial information of the Bank are submitted to the Board on a monthly basis. The implementation of the policy and the integrity and effectiveness of the Bank’s Management Information Systems were reviewed by the Internal Audit Department and discussed with the Board Audit Committee in February 2016. Thereafter, the Board at its meeting held in February 2016, reviewed the adequacy of the Bank’s Management Information Systems, based on the monthly MIS pack submitted to the Board each month and the integrity of the Management Information Systems, based on the process audit carried out by Internal Audit Department and confirmed the process and the system as satisfactory. |

|||||||||||||||

(f) Identify and designate key management personnel, as defined in Banking Act Determination No.3 of 2010 on the Assessment of fitness and propriety of officers performing executive functions in LCBs |

Complied |

Key Management Personnel of the Bank have been identified by the Board and presently include the following: 1. The Leadership Team 2. Company Secretary 3. Employees holding Director positions in subsidiaries |

|||||||||||||

(g) Define the areas of authority and key responsibilities for the Board Directors themselves and for the Key Management Personnel (KMP); |

Complied |

Areas of authority and key responsibilities of the Directors, have been set out in the Bank’s Internal Code of Corporate Governance, which is a Board approved document. Areas of authority and key responsibilities of Key Management Personnel, are defined in the respective job descriptions of each Key Management Personnel and were reviewed at the Nominations Committee and noted by the Board. Further, delegations of authority levels have been clearly defined by the Board for Key Management Personnel. |

|||||||||||||

(h) Ensure that there is appropriate oversight of the affairs of the Bank by Key Management Personnel, that is consistent with Board policy; |

Complied |

Oversight by the Board over Key Management Personnel, takes place at Board Meetings and through Board Committees. Key Management Personnel make regular presentations to the Board on matters under their purview and are also called in by the Board to explain matters relating to their respective areas. Banking Operations carried out in-line with the Banks’ strategic objectives, including any issues faced by the Bank, are discussed on a regular basis at Board Meetings. The CEO at weekly meetings held with the Leadership Team, updates them on key decisions taken by the Board. |

|||||||||||||

(i) Periodically assess the effectiveness of the Board Directors’ own governance practices, including: (i) the selection, nomination and election of Directors and Key Management Personnel; (ii) the management of conflicts of interests; and (iii) the determination of weaknesses and implementation of changes where necessary; |

Complied |

The effectiveness of the Board’s Governance practices are reviewed periodically. The Board appraises its own performance by responding to a self-assessment questionnaire by each Director, which includes the key areas detailed in this Direction. The responses are collated by the Company Secretary and submitted to the Chairman & Deputy Chairman for their review. The Chairman and Deputy Chairman then discuss areas of weaknesses and recommend changes where necessary at a Board meeting. The process was followed for the year 2015 and has been explained on this figure. |

|||||||||||||

(j) Ensure that the Bank has an appropriate succession plan for Key Management Personnel; |

Complied |

During 2015, the Board approved an interim succession plan for Key Management Personnel of the Bank. The interim succession plan will be reviewed/revalidated, by the Human Resources and Remuneration Committee (HRRC) and the Board in 2016 to ensure that the succession plan is relevant and appropriate vis-à-vis the prevailing organizational structure of the Bank. |

|||||||||||||

(k) Meet regularly, on a needs basis, with the Key Management Personnel to review policies, establish communication lines and monitor progress towards corporate objectives |

Complied |

Key Management Personnel are regularly present or are called in for discussions at the meetings of the Board and its Committees on policy and other matters relating to their areas. Progress towards corporate objectives is a regular agenda item for the Board and the Key Management Personnel are regularly involved in Board level discussions on same. |

|||||||||||||

(l) Understand the regulatory environment and ensure that the Bank maintains an effective relationship with regulators; |

Complied |

All new regulations issued by the Regulator, are circulated to the Board for their information on a quarterly basis by the Compliance Department. The CEO meets with Central Bank officials at the monthly CEO's meetings. The Chairman of the Bank and Chairpersons of Board Committees also have meetings with CBSL officials. Further, Directors, the Chief Executive Officer and Key Management Personnel of the Bank, maintain a dialogue with the regulators on an ongoing basis. |

|||||||||||||

(m) Exercise due diligence in the hiring and oversight of External Auditors. |

Complied |

Audit Committee Charter includes the functions of hiring and overseeing of External Auditors. The Board Audit Committee carries out the necessary due diligence regarding the hiring of the External Auditor and makes recommendations to the Board. Oversight of the External Auditor is carried out by the Board Audit Committee and the Board is briefed on any concerns in this regard if the necessity arises. |

|||||||||||||

The Board Audit Committee further reviews the non-audit services provided by the External Auditor annually and ensures that such services do not impair the independence and objectivity of the External Auditor. A formal evaluation of the External Auditors’ performance is completed annually by the Board Audit Committee and conclusions together with any recommendations are tabled at the Board meeting. |

|||||||||||||||

3 (1) (ii) |

The Board shall appoint the Chairman and the Chief Executive Officer and define and approve the functions and responsibilities of the Chairman and the Chief Executive Officer in line with Direction 3 (5) of these Directions. |

Complied |

The Board has appointed the Chairman and the Chief Executive Officer. The roles of the Chairman and the Chief Executive Officer are contained in the Articles of Association and the Bank’s internal Code of Corporate Governance. There is a clear division of responsibilities between the Chairman and the Chief Executive Officer, maintaining the balance of power between the two roles. |

||||||||||||

3 (1) (iii) |

The Board shall meet regularly and Board meetings shall be held at least twelve times a year, at approximately monthly intervals. Such regular Board meetings shall normally involve active participation in person of a majority of Directors entitled to be present. Obtaining the Board’s consent through the circulation of written resolutions/papers shall be avoided as far as possible. |

Complied |

Regular monthly Board meetings are held and special Board meetings are scheduled as and when the need arises. There have been 15 Board meetings during 2015. The attendance of Directors for Board and Committee meetings is set out in these tables. 4 Circular resolutions were passed during the year 2015. Circulation of Board papers to obtain Board’s consent is minimised and resorted to only when absolutely necessary. These decisions are in any event tabled at the immediately succeeding Board meeting. |

||||||||||||

3 (1) (iv) |

The Board shall ensure that arrangements are in place to enable all Directors to include matters and proposals in the agenda for regular Board meetings where such matters and proposals relate to the promotion of business and the management of risks of the Bank. |

Complied |

All Directors are entitled to include such matters and proposals in the Agenda for Board meetings and this right has been entrenched in the Bank’s Internal Code of Corporate Governance. Monthly meetings are scheduled and informed to the Board, at the beginning of each calendar year, to enable submission of proposals in the Agenda for regular meetings. |

||||||||||||

3 (1) (v) |

The Board procedures shall ensure that notice of at least 7 days is given of a regular Board meeting to provide all Directors an opportunity to attend. For all other Board meetings, reasonable notice may be given. |

Complied |

Monthly meetings are scheduled and informed to the Board at the beginning of each calendar year, to provide Directors an opportunity to attend meetings. Formal notice of meetings, the Agenda and Board papers related to each Board meeting are circulated to all Directors at least 7 days in advance of the Board meeting. These documents are now uploaded through a secure connection to the Ipad’s of all Directors. |

||||||||||||

3 (1) (vi) |

The Board procedures shall ensure that a Director who has not attended at least two-thirds of the meetings, in the period of 12 months immediately preceding or has not attended the immediately preceding three consecutive meetings held, shall cease to be a Director. Participation at the Directors’ meetings through an alternate Director shall, however, be acceptable as attendance. |

Complied |

The Company Secretary monitors the attendance register to ensure compliance. All Directors have attended at least two thirds (2/3) of the meetings held during 2015 and no Director has been absent from three consecutive meetings during 2015. |

||||||||||||

3 (1) (vii) |

The Board shall appoint a Company Secretary who satisfies the provisions of Section 43 of the Banking Act No. 30 of 1988, whose primary responsibilities shall be to handle the secretarial services to the Board and shareholder meetings and to carry out other functions specified in the statutes and other regulations. |

Complied |

The Board has appointed a Company Secretary, who is an Attorney-at-Law and who satisfies the provisions of Section 43 of the Banking Act. She is responsible to the Board for ensuring that Board procedures are followed and that applicable laws, rules and regulations are complied with. |

||||||||||||

3 (1) (viii) |

All Directors shall have access to the advice and services of the Company Secretary with a view to ensuring that Board procedures and all applicable rules and regulations are followed. |

Complied |

All Directors have access to the advice and services of the Company Secretary. For the year 2015, the Company Secretary has provided assistance to the Directors when requested. The Bank’s Internal Code of Corporate Governance also includes this provision. |

||||||||||||

3 (1) (ix) |

The Company Secretary shall maintain the minutes of Board meetings and such minutes shall be open for inspection at any reasonable time, on reasonable notice by any Director. |

Complied |

The Company Secretary maintains detailed Board minutes and circulates minutes to all Directors. The minutes are approved at the subsequent Board meetings. The Bank’s Internal Code of Corporate Governance also provides that minutes are open for inspection at any reasonable time, on reasonable notice by any Director. Additionally, copies have been provided of previous meetings to Directors when requested. |

||||||||||||

3 (1) (x) |

Minutes of Board meetings shall be recorded in sufficient detail so that it is possible to gather from the minutes, as to whether the Board acted with due care and prudence in performing its duties. The minutes shall also serve as a reference for regulatory and supervisory authorities, to assess the depth of deliberations at the Board meetings. Therefore, the minutes of a Board meeting shall clearly contain or refer to the following: (a) a summary of data and information used by the Board in its deliberations; (b) the matters considered by the Board; (c) the fact-finding discussions and the issues of contention or dissent which may illustrate whether the Board was carrying out its duties with due care and prudence; (d) the testimonies and confirmations of relevant executives which indicate compliance with the Board’s strategies and policies and adherence to relevant laws and regulations; (e) the Board’s knowledge and understanding of the risks to which the Bank is exposed and an overview of the risk management measures adopted; and (f) the decisions and Board resolutions. |

Complied |

The minutes contain adequate details appropriate to the matters dealt with. The minutes are read together with the corresponding Board papers, which supplement the information in the minutes. All matters required to be minuted in terms of 3(1) (x) (a) – (f) are recorded in the minutes. |

||||||||||||

3 (1) (xi) |

There shall be a procedure agreed by the Board to enable Directors, upon reasonable request, to seek independent professional advice in appropriate circumstances, at the Bank’s expense. The Board shall resolve to provide separate independent professional advice to Directors to assist the relevant Director or Directors to discharge his/her/their duties to the Bank. |

Complied |

Independent professional advice is available, on request, to all Directors at the expense of the Bank. The Bank’s internal Code of Corporate Governance has put in place a procedure which enables independent professional advice to be obtained jointly or severally by a Director or Directors where such advice is necessary to enable the fulfilment of the obligations imposed on a member of the Board. The Directors have obtained professional advice during the year. |

||||||||||||

3 (1) (xii) |

Directors shall avoid conflicts of interests, or the appearance of conflicts of interest, in their activities with and commitments to, other organisations or related parties. If a Director has a conflict of interest in a matter to be considered by the Board, which the Board has determined to be material, the matter should be dealt with at a Board meeting, where Independent Non-Executive Directors [refer to Direction 3 (2) (iv) of these Directions] who have no material interest in the transaction, are present. Further, a Director shall abstain from voting on any Board resolution in relation to which he/she or any of his/her close relation or a concern in which a Director has substantial interest, is interested and he/she shall not be counted in the quorum for the relevant agenda item at the Board meeting. |

Complied |

The Directors are conscious of their obligation to deal with situations where there is a conflict of interest in accordance with the Articles of Association of the Bank and the Corporate Governance Direction No. 11 of 2007 (as amended). The Internal Code of Corporate Governance adopted by the Board, requires each Board member to determine whether he/she has a potential or actual conflict of interest. If a Director of the Bank has a conflict of interest in a matter to be considered by the Board, which the Board has determined to be material, such matters are disclosed and discussed at the Board meetings, where Independent Non-Executive Directors who have no material interest in the transaction, are present. Further, Directors abstain from voting on any Board resolution in relation to which such Directors or any of their close relation/s or a concern in which such Directors have substantial interests, and/or are interested in. Further their votes are not counted in the quorum for the relevant agenda item at the Board meeting. |

||||||||||||

3 (1) (xiii) |

The Board shall have a formal schedule of matters, specifically reserved to it for decision, to ensure that the direction and control of the Bank is firmly under its authority. |

Complied |

A formal schedule of matters has been specifically reserved for the decision of the Board and detailed in the Bank’s internal Code of Corporate Governance. |

||||||||||||

3 (1) (xiv) |

The Board shall, if it considers that the Bank is or is likely to be, unable to meet its obligations or is about to become insolvent or is about to suspend payments due to depositors and other creditors, forthwith inform the Director of Bank Supervision of the situation of the Bank prior to taking any decision or action. |

Complied |

The Bank is aware of the requirement but the situation has not arisen within the year. A Solvency Statement is prepared quarterly and tabled at the Integrated Risk Management Committee (IRMC) and the Board. The Bank also has an IRMC approved Liquidity Contingency Funding plan in place. |

||||||||||||

3 (1) (xv) |

The Board shall ensure that the Bank is capitalized at levels as required by the Monetary Board, in terms of the capital adequacy ratio and other prudential grounds. |

Complied |

Monthly and quarterly compliance reports have been submitted to the Board, which contains the Capital Adequacy Ratio (CAR). The Bank is fully compliant with the Capital Adequacy requirements stipulated by the Central Bank of Sri Lanka. Also the ICAAP covers capital planning over the next 3 years. |

||||||||||||

3 (1) (xvi) |

The Board shall publish in the Bank’s Annual Report, an annual corporate governance report setting out the compliance with Direction 3 of these Directions. |

Complied |

This requirement is met through the presentation of this Report |

||||||||||||

3 (1) (xvii) |

The Board shall adopt a scheme of self-assessment to be undertaken by each Director annually and maintain records of such assessments. |

Complied |

The Board has in place, an annual scheme of self-assessment, which is undertaken by each Director annually and records are maintained with the Company Secretary. The summary of findings together with areas for future improvement, is tabled at the Board Meeting for discussion. |

||||||||||||

3 (2) |

The Board’s Composition |

|

|

||||||||||||

3 (2) (i) |

The number of Directors on the Board shall not be less than 7 and not more than 13. |

Complied |

The composition, as required under this Direction, was met during the year 2015. The Bank’s Board comprised of 10 Directors during the year 2015. |

||||||||||||

3 (2) (ii) |

The total period of service of a Director, other than a Director who holds the position of Chief Executive Officer, shall not exceed nine years. |

Complied |

All Directors comply with this requirement. |

||||||||||||

3 (2) (iii) |

An employee of a bank may be appointed, elected or nominated as a Director of the Bank (hereinafter referred to as an ‘Executive Director’) provided that the number of Executive Directors shall not exceed one-third of the number of Directors of the Board. In such an event, one of the Executive Directors shall be the Chief Executive Officer of the Bank. |

Complied |

The Chief Executive Officer is the only employee on the Board. Accordingly, the number of Executive Directors do not exceed one-third of the Directors on the Board. |

||||||||||||

3 (2) (iv) |

The Board shall have at least three independent Non-Executive Directors or one-third of the total number of Directors, whichever is higher. This subdirection shall be applicable from 01 January 2010 onwards. A Non-Executive Director shall not be considered independent if he/she: a. has direct and indirect shareholdings of more than 1% of the Bank; b. currently has or had during the period of two years, immediately preceding his/her appointment as Director, any business transactions with the Bank as described in Direction 3 (7) hereof, exceeding 10% of the regulatory capital of the Bank. |

Complied |

There are 9 Non-Executive Directors on the Board as at 31 December 2015. Of them 6 are Independent Non-Executive Directors. Non-Executive Directors are detailed under this section. Accordingly, the number of Independent Non-Executive Directors exceeds one-third of the total number of Directors on the Board. The Board assesses the Independence or Non-Independence of each Non-Executive Director, based on a declaration made by each Director to the Company Secretary each year. |

||||||||||||

c. has been employed by the Bank during the two year period, immediately preceding the appointment as Director; |

|||||||||||||||

d. has a close relation, who is a Director or Chief Executive Officer or a member of Key Management Personnel or a material shareholder of the Bank or another Bank. For this purpose, a ‘close relation’ shall mean the spouse or a financially dependant child; e. represents a specific stakeholder of the Bank; f. is an employee or a Director or a material shareholder in a company or business organization: I. which currently has a transaction with the Bank as defined in Direction 3 (7) of these Directions, exceeding 10% of the regulatory capital of the Bank, or II. in which any of the other Directors of the Bank are employed or are Directors or are material shareholders; or III. in which any of the other Directors of the Bank have a transaction as defined in Direction 3 (7) of these Directions, exceeding 10% of regulatory capital in the Bank; |

|||||||||||||||

3 (2) (v) |

In the event an Alternate Director is appointed to represent an Independent Director, the person so appointed shall also meet the criteria that applies to the Independent Director. |

Complied |

Directors appoint Alternate Directors in-line with the Articles of the Bank, as and when required for a particular meeting. Persons so appointed during the year 2015, have met the criteria to ensure that the independent profile of the respective Director is met. |

||||||||||||

3 (2) (vi) |

Non-Executive Directors shall be persons with credible track records and/or have necessary skills and experience to bring an independent judgement to bear on issues of strategy, performance and resources. |

Complied |

The Non-Executive Directors of the Bank are persons with credible track records and have necessary skills and experience to bring an independent judgement to bear on issues of strategy, performance and resources. Please refer the profiles of the Non-Executive Directors. The Bank has a specific documented Board approved process in place for appointing Non-Executive Directors. |

||||||||||||

3 (2) (vii) |

A meeting of the Board shall not be duly constituted, although the number of Directors required to constitute the quorum at such meeting is present, unless more than one half of the number of Directors present at such meeting are Non-Executive Directors. |

Complied |

Attendance of Directors is monitored by the Company Secretary and is strictly observed. It was noted that more than one half (1/2) of Directors present at each meeting of the Board convened in the year 2015 were Non-Executive Directors. |

||||||||||||

3 (2) (viii) |

The Independent Non-Executive Directors shall be expressly identified as such in all corporate communications that disclose the names of Directors of the Bank. The Bank shall disclose the composition of the Board, by category of Directors, including the names of the Chairman, Executive Directors, Non-Executive Directors and Independent Non-Executive Directors in the annual Corporate Governance Report. |

Complied |

The Independent Non-Executive Directors are expressly identified as such in all corporate communications that disclose the names of Directors of the Bank. The composition of the Board, by category of Directors, including the names of the Chairman, Executive Director, Non-Executive Directors and Independent Non-Executive Directors are given under this section. |

||||||||||||

3 (2) (ix) |

There shall be a formal, considered and transparent procedure for the appointment of new Directors to the Board. There shall also be procedures in place for the orderly succession of appointments to the Board. |

Complied |

The Board has established a Nominations Committee in conformity with the requirements of this Direction. All new appointments and re-election of Directors are on the recommendations of the Nominations Committee. Central Bank approval is obtained in terms of the Banking Act for the appointment of a new Director. The Bank has a specific documented Board approved process in place for appointing Non-Executive Directors. |

||||||||||||

3 (2) (x) |

All Directors appointed to fill a casual vacancy, shall be subject to election by shareholders at the first general meeting after their appointments. |

Complied |

Appointment to fill a casual vacancy is made by the Board on the recommendations of the Nominations Committee. A person so appointed would stand for re-election at the next Annual General Meeting, in accordance with the Articles of Association. Three Directors, N G Wickremeratne, D M R Phillips and K D W Ratnayaka were appointed in 2015 to fill casual vacancies and thereby will stand for re-appointment by the shareholders at the Annual General Meeting. |

||||||||||||

3 (2) (xi) |

If a Director resigns or is removed from office, the Board shall: (a) announce the Director’s resignation or removal and the reasons for such removal or resignation, including but not limited to information relating to the relevant Director’s disagreement with the Bank, if any; and (b) issue a statement confirming whether or not there are any matters that need to be brought to the attention of shareholders. |

Complied |

Four Directors, Ms. G D C Ekanayake, S G Wijesinha, S Rajapakse and H A Siriwardena resigned from the Bank in 2015. The Bank informed the regulatory authorities and shareholders in terms of CSE requirements of such resignation stating the reasons for such resignation and confirming that there were no matters that needed to be brought to the attention of shareholders. |

||||||||||||

3 (2) (xii) |

A Director or an employee of a Bank shall not be appointed, elected or nominated as a Director of another bank, except where such a bank is a subsidiary company or an associate company of the first mentioned bank. |

Complied |

The Nominations Committee takes into account this requirement in their deliberations when considering the appointments of Directors. The Bank’s Compliance Policy and Code of Conduct, further incorporates this requirement for employees. No Director or Employee of the Bank is a Director of another bank. |

||||||||||||

3 (3) |

Criteria to assess the fitness and propriety of Directors |

|

|||||||||||||

3 (3) (i) |

The age of a person who serves as Director shall not exceed 70 years. |

Complied |

There are no Directors who are over 70 years of age. |

||||||||||||

3 (3) (ii) |

A person shall not hold office as a Director of more than 20 companies/entities/institutions inclusive of subsidiaries or associate companies of the Bank. |

Complied |

No Director holds Directorships of more than 20 companies. The other directorships of each of the Directors is disclosed on Pages 108 to 115 of the Annual Report |

||||||||||||

3 (4) |

Management Function Delegated by the Board |

|

|

||||||||||||

3 (4) (i) |

The Directors shall carefully study and clearly understand the delegation arrangements in place. |

Complied |

The Board periodically reviews and approves the delegation arrangements in place and ensures that the extent of delegation addresses the needs of the Bank, whilst enabling the Board to discharge their functions effectively. Delegation papers are prepared in detail and recommended by the IRMC to the Board. Terms of Reference of each of the Board Committees, which are incorporated in the respective charters of each Board Committee, are approved by the Board. In addition, it is to be noted that by delegating, the Board does not lose the authority to deal with matters that have been delegated when necessary. |

||||||||||||

3 (4) (ii) |

The Board shall not delegate any matters to a Board Committee, Chief Executive Officer, Executive Directors or Key Management Personnel, to an extent that such delegation would significantly hinder or reduce the ability of the Board as a whole to discharge its functions. |

||||||||||||||

3 (4) (iii) |

The Board shall review the delegation processes in place on a periodic basis to ensure that they remain relevant to the needs of the Bank. |

||||||||||||||

3 (5) |

The Chairman and Chief Executive Officer |

|

|

||||||||||||

3 (5) (i) |

The roles of Chairman and Chief Executive Officer shall be separate and shall not be performed by the same individual. |

Complied |

The roles of Chairman and Chief Executive Officer of the Bank, are held by separate individuals. In addition, there is a clear division of responsibilities between the Chairman and the Chief Executive Officer, thereby maintaining the balance of power between the two roles. |

||||||||||||

3 (5) (ii) |

The Chairman shall be a Non-Executive Director and preferably an Independent Director as well. In the case where the Chairman is not an Independent Director, the Board shall designate an Independent Director as the Senior Director with suitably documented terms of reference, to ensure a greater independent element. The designation of the Senior Director shall be disclosed in the Bank’s Annual Report. |

Complied |

The Chairman is a Non-Executive, Independent Director and therefore, the appointment of an Independent Director as the Senior Director, does not arise. |

||||||||||||

3 (5) (iii) |

The Board shall disclose in its corporate governance report, which shall be an integral part of its Annual Report, the identity of the Chairman and the Chief Executive Officer and the nature of any relationship [including financial, business, family or other material/relevant relationship(s)], if any, between the Chairman and the Chief Executive Officer and the relationships among members of the Board. |

Complied |

There is a process in place which requires all Directors to declare to the Board, any relationship/s they may have with the Chairman, the CEO or among members of the Board. Based on the above declarations, the Board can state that no relationship/s [including financial, business, family or other material/relevant relationships] exist between the Chairman and Chief Executive Officer and among the other members of the Board, other than Directors who sit together on some of the Boards of the Bank's subsidiaries. |

||||||||||||

3 (5) (iv) |

The Chairman shall: (a) provide leadership to the Board; (b) ensure that the Board works effectively and discharges its responsibilities; and (c) ensure that all key and appropriate issues are discussed by the Board in a timely manner. |

Complied |

The Chairman is responsible for the running of the Board, preserving order and ensuring that proceedings at meetings are conducted in a proper manner. Further, he ascertains the views of the Directors on the issues being discussed, before decisions are taken. The self-evaluation process carried out by the members of the Board each year, assists the Chairman to effectively carry out his responsibilities by providing him the required feedback. |

||||||||||||

3 (5) (v) |

The Chairman shall be primarily responsible for drawing up and approving the agenda for each Board meeting, taking into account where appropriate, any matters proposed by the other Directors for inclusion in the agenda. The Chairman may delegate the drawing up of the agenda to the Company Secretary. |

Complied |

The Chairman draws up the Agenda for Board meetings in consultation with the Chief Executive Officer and Company Secretary. The Bank’s Internal Code of Corporate Governance also casts this responsibility with the Chairman. |

||||||||||||

3 (5) (vi) |

The Chairman shall ensure that all Directors are properly briefed on issues arising at Board meetings and also ensure that Directors receive adequate information in a timely manner. |

Complied |

The Directors are adequately briefed in the course of discussions by the Chairman, Chief Executive Officer and officers of management in respect of matters that are taken up by the Board. The following procedures are in place to ensure this: Board papers are circulated in advance among the Directors, Management information is provided on a regular basis to enable Directors to assess the performance and stability of the Bank, relevant Key Management Personnel are on hand for explanations and clarifications and Directors are able to seek independent professional advice on a needs basis at the Bank’s expense. |

||||||||||||

3 (5) (vii) |

The Chairman shall encourage all Directors to make a full and active contribution to the Board’s affairs and take the lead to ensure that the Board acts in the best interests of the Bank. |

Complied |

The Chairman ensures that all members effectively participate as a team in Board decisions and Directors concerns and comments are duly recorded in the minutes. |

||||||||||||

3 (5) (viii) |

The Chairman shall facilitate the effective contribution of Non-Executive Directors in particular and ensure constructive relations between Executive and Non-Executive Directors. |

Complied |

9 of the 10 Board members are Non-Executive Directors which encourages active participation by the Non-Executive Directors. Further, Non-Executive Directors participate in Board appointed Committees, providing further opportunity for active participation. In addition, the feedback received from the self-evaluation process carried out by the Board supports the Chairman in improving contributions of Non-Executive Directors. |

||||||||||||

3 (5) (ix) |

The Chairman, shall not engage in activities involving direct supervision of Key Management Personnel or any other executive duties whatsoever. |

Complied |

The Chairman is a Non-Executive Director and is not involved in the day-to-day operations of the Bank. |

||||||||||||

3 (5) (x) |

The Chairman shall ensure that appropriate steps are taken to maintain effective communication with shareholders and that the views of shareholders are communicated to the Board. |

Complied |

Shareholders are encouraged to provide their feedback to the Company Secretary using feedback forms made available with the Annual Report. In addition, there is an e-mail address dedicated for investor relations and the link is available on the Bank’s website. The Chairman together with the CEO, ensures effective communication with shareholders through investors’ forums held each quarter and through continuous engagements with our institutional investors. Members of the Board are apprised of the views of major investors and other key stakeholders, pursuant to these meetings. |

||||||||||||

3 (5) (xi) |

The Chief Executive Officer shall function as the apex executive-in-charge of the day-to-day management of the Bank’s operations and business. |

Complied |

The Chief Executive Officer is responsible for providing the leadership, expertise and professional environment within the Bank for the implementation of the Board’s policies and the achievement of the Bank’s goals and objectives. The operations of the Bank are carried out in conformity to this requirement. |

||||||||||||

3 (6) |

Board Appointed Committees |

|

|

||||||||||||

3 (6) (i) |

Each bank shall have at least four Board Committees as set out in Directions 3 (6) (ii), 3 (6) (iii), 3 (6) (iv) and 3 (6) (v) of these Directions. Each committee shall report directly to the Board. All committees shall appoint a secretary to arrange the meetings and maintain minutes, records, etc., under the supervision of the Chairman of the Committee. The Board shall present a report of the performance on each committee, on their duties and roles at the Annual General Meeting. |

Complied |

The Board has established a Corporate Governance and Legal Affairs Committee, a Strategic Issues Committee and a Related Party Transactions Review Committee in addition to the four Board Committees required in terms of this Direction, namely the Audit Committee, Human Resources and Remuneration Committee, Nominations Committee and Integrated Risk Management Committee. Recommendations of such Committees are addressed directly to the Board for decision and minutes of Committee meetings are tabled and discussed at the main Board Meetings. This Annual Report includes individual reports of each such Committee which reports include a summary of duties, roles and performance of each of the Committees. |

||||||||||||

3 (6) (ii) |

The following rules shall apply in relation to the Audit Committee: |

||||||||||||||

(a) The Chairman of the Committee shall be an Independent Non-Executive Director, who possesses qualifications and experience in accountancy and/or audit. |

Complied |

T L F Jayasekera, the Chairman of the Board Audit Committee is an Independent Non-Executive Director and a Fellow Member of the Institute of Chartered Accountants of Sri Lanka and an Associate Member of the Chartered Institute of Management Accountants, UK. The members of the Board Audit Committee are detailed on the Board Audit Committee Report. |

|||||||||||||

(b) All members of the Committee shall be Non-Executive Directors. |

Complied |

All members of the Board Audit Committee (BAC) are Non-Executive Directors. |

|||||||||||||

(C) The Committee shall make recommendations on matters in connection with: (i) the appointment of the External Auditor for audit services to be provided in compliance with the relevant statutes; (ii) the implementation of the Central Bank guidelines issued to Auditors from time to time; (iii) the application of the relevant accounting standards; and (iv) the service period, audit fee and any resignation or dismissal of the Auditor; provided that the engagement of the Audit partner shall not exceed five years and that the particular Audit partner is not re-engaged for the audit, before the expiry of three years from the date of the completion of the previous term. |

Complied |

The matters referred to in the Direction are reviewed and appropriate recommendations are made by the BAC; i. Appointment of the External Auditor for audit services has been recommended to the Board by the BAC; The BAC has discussed the audit plan and methodology with the External Auditors. ii. BAC has discussed the implementation of the Central Bank guidelines issued to Auditors from time to time and the application of the relevant accounting standards; iii. The External Audit Partner was rotated during 2013 as per the five-year rotation requirement, in order to ensure the independence of the Auditor and to comply with the requirements of this Direction. iv. The Committee evaluates and makes recommendations to the Board with regard to the audit fee. Refer the ‘Report of the Board Audit Committee’. |

|||||||||||||

(d) The Committee shall review and monitor the External Auditors’ Independence and objectivity and the effectiveness of the audit processes, in accordance with applicable standards and best practices. |

Complied |

The BAC obtains representations from the External Auditor on their independence and that the audit is carried out in accordance with the Sri Lanka Accounting Standards (SLFRSs/LKASs). |

|||||||||||||

(e) The Committee shall develop and implement a policy on the engagement of an External Auditor to provide non-audit services that are permitted under the relevant statutes, regulations, requirements and guidelines. In doing so, the Committee shall ensure that the provision by an External Auditor of non-audit services does not impair the External Auditors’ independence or objectivity. When assessing the External Auditors’ independence or objectivity in relation to the provision of non-audit services, the Committee shall consider: i. whether the skills and experience of the audit firm make it a suitable provider of the non-audit services; |

Complied |

A policy for ‘Engaging the External Auditor for non-audit services’ is in place which covers all aspects stated in this Direction. This Policy was last reviewed and approved by the BAC and Board in 2014, and will be reviewed every two years. |

|||||||||||||

ii. whether there are safeguards in place to ensure that there is no threat to the objectivity and/or independence in the conduct of the audit resulting from the provision of such services by the External Auditor; and |

|||||||||||||||

iii. whether the nature of the non-audit services, the related fee levels and the fee levels individually and in aggregate relative to the audit firm, pose any threat to the objectivity and/or independence of the External Auditor. |

|||||||||||||||

(f) The Committee shall, before the audit commences, discuss and finalise with the External Auditors, the nature and scope of the audit, including: i. an assessment of the Bank’s compliance with the relevant Directions in relation to corporate governance and the management’s internal controls over financial reporting; ii. the preparation of Financial Statements for external purposes, in accordance with relevant accounting principles and reporting obligations; and iii. the co-ordination between firms, where more than one audit firm is involved. |

Complied |

The BAC Charter requires the BAC to discuss and finalise with the External Auditor, the nature and scope of the audit. In order to comply, the External Auditors make a presentation at the BAC meeting with details of the proposed audit plan and the scope. Members of the BAC obtain clarifications in respect of the contents of the presentation, if deemed necessary, prior to adopting the audit plan, methodology and scope. As all audits within the Group are carried out by the same External Auditor, there was no requirement to co-ordinate activities with other audit firms. |

|||||||||||||

(g) The Committee shall review the financial information of the Bank, in order to monitor the integrity of the Financial Statements of the Bank, its Annual Report, accounts and quarterly reports prepared for disclosure and the significant financial reporting judgements contained therein. In reviewing the Bank’s Annual Report and accounts and quarterly reports before submission to the Board, the Committee shall focus particularly on: (i) major judgemental areas; (ii) any changes in accounting policies and practices; (iii) significant adjustments arising from the audit; (iv) the going concern assumption; and (v) the compliance with relevant accounting standards and other legal requirements. |

Complied |

Quarterly Financial Statements as well as year end Financial Statements are reviewed and discussed at BAC meetings. Once the members of the BAC have obtained the required clarifications, in respect of all aspects included in the Financial Statements, such Financial Statements are recommended for approval of the Board of Directors. |

|||||||||||||

(h) The Committee shall discuss issues, problems and reservations arising from the interim and final audits and any matters the Auditor may wish to discuss, including those matters that may need to be discussed in the absence of Key Management Personnel, if necessary. |

Complied |

The Committee met the External Auditors in June and October in 2015, without the presence of Key Management Personnel, to discuss any issues, problems and reservations arising from their audits. |

|||||||||||||

(i) The Committee shall review the External Auditor’s Management Letter and the management’s response thereto. |

Complied |

During the year, the BAC reviewed the Management Letter for the year ended 2014 and the responses thereto with the External Auditor, CEO and CFO. |

|||||||||||||

(j)The Committee shall take the following steps with regard to the internal audit function of the Bank: i. Review the adequacy of the scope, functions and resources of the Internal Audit Department, and satisfy itself that the department has the necessary authority to carry out its work; ii. Review the internal audit programme and results of the internal audit process and, where necessary, ensure that appropriate actions are taken on the recommendations of the Internal Audit Department. iii. Review any appraisal or assessment of the performance of the head and senior staff members of the Internal Audit Department; |

Complied |

The BAC has oversight of the Internal Audit Department (IAD) of the Bank and carries out the following duties: i. Reviews and discusses with the Head of Internal Audit (HIA), the annual audit plan covering the Group, the adequacy of the scope and functions and the resources of IAD. ii. The audit plan for the year is approved by the BAC and the progress is tabled at the BAC meetings along with the number of audits planned for the ensuing quarter. The BAC reviews the internal audit reports and discusses the Management Action Plans to resolve the issues raised by IAD. Further, BAC members are kept informed of issues arising from ongoing audits, as a ‘Heads up’. All audit findings are sent to Operational Risk Department for inclusion in the Risk Grid and for necessary follow up. iii. The CEO has carried out the appraisal of the HIA in consultation with Chairman BAC for 2014. Reviews of the performance of the HIA, new senior team leaders appointed in IAD for 2015 will be reviewed in March 2016 |

|||||||||||||

iv. Recommend any appointment or termination of the head, senior staff members and outsourced service providers to the internal audit function. v. Ensure that the Committee is appraised of resignations of senior staff members of the Internal Audit Department including the Head Internal Audit and any outsourced service providers and to provide an opportunity to the resigning senior staff members and outsourced service providers to submit reasons for resigning. vi. Ensure that the internal audit function is independent of the activities it audits and that it is performed with impartiality, proficiency and due professional care. |