Management Discussion and Analysis

and Customer Capital Formation

Our customers are served with utmost care and passion

90% of our branches has scored code 8/10 or more on customer feedback scores

Customers are at the heart of our business. Our definition of ‘service’ ensures they are always at the top of our minds and are served with utmost care and passion. We deliver on our commitments with superior and consistent service to all our customers across all regions and touch points across the Bank.

Delivering on Service

Values that Underpin Our Commitment

| Our Values | How We Serve Our Customers |

| Integrity | We value the relationship we hold with our customers. All our dealings are ethical, fair and honest. |

| Creativity | We solve problems by being creative and it has always been our path to success. |

| Excellence | We use all our energy, skills and resources to deliver great service and outstanding sustainable results. |

| Sincerity | Our priority is to listen to our customers to gain a better understanding of what they need. |

| Accountability | We help create, grow and protect wealth so that individuals, corporations, and wider society can achieve their ambitions in a responsible manner. |

The power of technology has raised customer expectations, but also reduced the cost to serve through automation, process improvement and innovation while enhancing customer experiences through faster service, greater reliability and personalized solutions.

Our customer service guiding principles are aligned with the Customer Charter Regulations, and go even beyond. We have in place key performance indicators and measures to manage this process.

What Gets Measured Gets Managed

Knowing Our Customers

| Segment | Customer Segment | Size | Price Sensitivity | Products and Services of Interest | Frequency of Transactions | Competition within the Industry |

| Commercial banking | Short and medium term needs of the large and middle market customers | Annual business turnover over LKR 600 million | High | Short-term loans, trade finance, overdrafts, leases, deposits and treasury products | High | High |

| Project and infrastructure financing | Long-term financial requirements of large and middle market customers. | Annual business turnover over LKR 600 million |

High | Long-term loans, Islamic banking long-term financing products, lease facilities, investment banking products, deposits, treasury products |

Moderate | High |

| Privilege Select banking | High net worth individuals and professionals | Banking relationships above LKR 20 million | High | Relationship banking, investment banking, share trading and wealth management | Moderate | High |

| Mass market/retail banking | Salaried employees [self employed, retirees, others] |

Individual customers | Low | Transactional | Moderate | Moderate |

| Micro and SME financing | Small and medium size business | Annual business turnover below LKR 600 million |

High | Financing capacity building |

Moderate | High |

Tailoring Our Products and Services

We regularly review our portfolio based on customer feedback as well as in response to anticipated opportunities and threats in the external environment. These products and services are designed with a customer focus and strong brand identity, and comprise

the following:

Commercial Banking

- Working capital

- Short-term loans and overdraft facilities

- Trade finance

- Cash management

- Treasury products and services

- Distributor financing

- Receivable financing

- Islamic banking

- Guarantees

Project and Infrastructure Financing

- Term loans including syndicated and co-financing facilities

- Securitizations

- Debentures

- Preference share investments

- Guarantees related to project financing

- Project financing related legal services

- Long-term Islamic Banking solutions

Retail Banking

- Current accounts

- Privilege Select, Privilege banking

- Savings accounts, Children’s savings accounts

- NDB Salary Max

- NRFC/RFC accounts

- Fixed deposits

- Housing loans

- Education loans

- Personal loans

- Leasing and hire purchase facilities

- NDB credit cards, debit cards

- Pawning

- Remittances, money transfer services

- Internet banking

- Bancassurance

- Safe deposit lockers

- E-statement

- Margin trading

- Travel card

Micro and SME Financing

- Long-term loans

- Short-term working capital loans

- Distributor finance facilities

- Supplier banking products

- Funding for importers and exporters

- Customized, industry specific products (tea, cinnamon, etc.)

In addition the Bank cross sells capital markets products and services of the Group companies. These include:

- Investment banking products and services

- Stock broking

- Wealth management

- Private equity fund management

Feedback and Feedforward

Our call centre is structured on four broad platforms, each with a distinct strategic purpose.

24 x 7 Customer Service Hotline

Our dedicated customer service team provides around the clock full service including card activation, lost card deactivation, handling balance and transaction inquiries etc. In addition to routine queries the call centre also handles the Online Banking mail box and the contact@ndbbank.com. All queries received via these mail channels are acted upon within three working days.

Telemarketing Unit

This function within the call centre mainly focuses on revenue generation through cross selling and upselling. A telephone survey is carried out by the team on a monthly basis to measure the customer satisfaction level across the branch network. Findings and customer feedback are then shared with the retail banking network for necessary process improvements and to address staff training and development needs. Telemarketing team members are groomed to be cross functional and are capable of serving customers in different capacities.

24 x 7 Transaction Monitoring Unit

As a responsible Bank we take due responsibility in safeguarding customers. Our transaction monitoring team monitors transactions 24 X 7. Proactive and skilled team members promptly act upon identifying high risk transactions and ensure appropriate action is taken.

Operator Assistance

A dedicated team handles direct calls received from existing and potential customers between 8.30 am and 5.00 pm. These calls are typically in the nature of general inquiries from those seeking specific banking services and those who are interested in opening accounts, obtaining loans, credit cards etc.

Products Campaigns

Lifestyle Statements

The Bank developed an interactive e-statement, referred to as the ‘Lifestyle Statement’ during the year. It depicts the customer’s entire relationship with the Bank. The statement not only includes the details of all the deposits accounts, but also credit cards, wealth management and stock brokering. This interactive statement has also become an example of the Bank’s commitment to sustainable practices. This innovative interactive e-statement won the Bronze Award at the National Best Quality Software Awards 2015, which confirms that it is a ‘one of a kind’ in the local market.

NDB Shilpa

NDB Shilpa is a savings proposition for minors, aimed at including the habit of savings and rewarding them for conforming with the savings habit. Following its introduction in 2014, this has made its way into many households in the country to satisfy every parent’s aspiration to educate their child. NDB Shilpa motivates students towards academic excellence while offering attractive cash rewards to its account holders who excelled in the Government Grade 5 Scholarship Examination.

Going further, the Bank initiated a series of educational seminars to students of Grades 4 and 5 in 50 schools around the country. The campaign continued under the theme ‘Education is the best Gift for a Child’ and consisted of TV, radio, press and magazine advertising in Sinhala, Tamil and English.

Easy Saver and Big Saver

Easy Saver and Big Saver are the two most recent savings propositions introduced by the Bank. They are a reclassification of Regular, Special, Flexi, Premium and Savings Star accounts as Easy Saver and the Savings Star Plus accounts as Big Saver. This is in line with the Bank’s ‘Ithurukarana Maga’ campaign that promotes a simpler proposition which is less complex and easy to manage.

Privilege Select

The Privilege Select clientele of the Bank are treated to unique experiences in a bid to strengthen their association and engagement with the NDB brand. An inter school golf tournament was held in September 2015 with the Bank as the principal sponsor of the year’s tournament that was organized by the past pupils of Holy Family Convent, Bambalapitiya. The event attracted 275 persons and significant media coverage.

NDB Leasing

The Bank competes with other banks, finance companies and leasing companies in the leasing and hire purchase business segment. Our marketing communications for leasing included TV, radio, press advertising, public relations and online media campaigns as well as tie-ups with key vehicle dealers and agents in the country. The latter include Dimo, Sathosa Motors, United Motors and AMW.

To create further awareness across the island ‘NDB Leasing Riyapola’ vehicle fairs were held in Embilipitiya, Jaffna, Nuwara Eliya, Anuradhapura, Dambulla, Kiribathgoda, Galle, Colombo and Matara during the year.

Riya Abhiman

The interim budget proposals to reduce taxes on the small car segment, coupled with the increase in salaries of Government employees and the prevailing decline in fuel prices saw a surge in demand for small vehicles. The Bank’s strategic response to this anticipated demand spike was to extend the NDB Riya Abhiman promotion period until end of December 2015 under the theme ‘Riya Abhiman – vehicles for Government Employees’.

The scheme was a remarkable success, with the Bank’s leasing staff and business development associates providing a personalized service at the customer’s door step. Continuous training and development of the front and back office staff and timely process improvement also contributed to the success of this endeavour.

Jaffnaspire

A first of its kind town storming, the Retail Banking Division set in motion ‘Jaffnaspire’ a promotional campaign to increase brand awareness and market share in the Jaffna District. Jaffnaspire, led by the CEO of the Bank, was a week-long event focused on listening to customers, to better understand their needs while providing retail and other financial solutions.

Despite the business nature of Jaffnaspire, the Bank also participated in several CSR activities, such as providing much needed equipment to the Tellipallai hospital, orphanages and schools.

Micro and SME Development

Forming the backbone of Sri Lanka’s economy and as the principal source of employment creation, the micro and small and medium enterprises (SME) sectors have been an integral component of the Bank’s business since its founding. It has been a role that goes beyond the mere provision of finance.

Providing Concessionary Financing

The Bank is an active participating financial institution in the Small & Medium Enterprise Development Facility Project (SMEDeF) funded by the World Bank via Government of Sri Lanka and the Small & Micro Industries Leader and Entrepreneur Promotion Project III - (SMILE III Revolving Fund), implemented by the Ministry of Industry & Commerce. These are concessionary funding schemes that also encourage technical assistance to strengthen and develop the SME sector on a sustainable path.

The Bank participates on cost sharing basis with the SMEDeF Project implemented by the Ministry of Finance and Planning in carrying out empowerment initiatives in the SME sector. During the year we conducted 23 SME training/capacity building workshops across the country. These workshops attracted over 2,500 SMEs that included both existing as well as prospective customers of the Bank. Resource persons were selected by the Bank, drawing in experts in diverse fields from within the NDB Group as well as external institutions such as the Central Environmental Authority, universities and practitioners.

Furthermore, in the Conscious Report issued by the Ministry of Finance to make closing remarks of the SMEDeF credit line, which concluded in September 2015, the Bank was ranked first in the utilization of the Technical Assistance Fund and fourth in the utilization of the Line of Credit under the credit line.

Piloting Urban Micro Financing

The Bank’s pilot project on financial inclusion in partnership with the Colombo Municipal Council (CMC) and Sri Lanka Food Processing Association gathered further momentum during the year. Commencing with micro financing to a group of three street food vendors at the Galle Face Green, the project now has around 200 beneficiaries. Capacity building initiatives include awareness creation campaigns on food safety by the Public Health Unit of the CMC, while the Bank provides guidance on cash management. The individual working capital loans typically amount to LKR 250,000 each with tenors of

12 - 18 months. They are secured through a group guarantee scheme

that has seen a 100% recovery rate.

Taking Cinnamon to the World

Cinnamon has long held a significant position in Sri Lankan culture and economy, its earliest mention going back over two thousand years. Despite cinnamon’s potential as a major export crop, its supply chain had not received the financial backing required to elevate the industry to the next level. The Bank ventured into this space in January 2014 through a national initiative that aims to empower the cinnamon industry in the country.

Through the Bank’s micro finance arm, we serve even the most remote village in any of the five cinnamon-growing districts of the country, encompassing the total supply chain from home garden cinnamon growers and tappers to product processors and exporters.

Our venture into this sector also saw the Bank opening a branch at Uragasmanhandiya in 2014, a bustling centre of action for cinnamon. Loans – mainly for land preparation for cultivation and working capital – are tailor-made for the cinnamon industry, ensuring that even the poorest will qualify for financial assistance. Coupled with building a strong credit culture among the beneficiaries, the Bank’s role includes provision of technical knowledge and extension services, often in collaboration with Government institutions. The latter include Ministry of Minor Export Crop Promotion, Department of Export Agriculture and regional Cinnamon Research Institutions.

NDB teamed up with Citi Bank and Ceylon Chamber of Commerce to promote entrepreneurship at the very bottom of the economic pyramid by reaching unbanked and under developed settlements. The pilot project started in a cinnamon based village, Dadayamkanda, Embilipitiya. These initiatives were targeted primarily towards the upliftment and empowerment of the said cinnamon farmers. Several training sessions were conducted on positive thinking and financial literacy after which the Bank would provide financial assistance for the farmer community.

Empowering Women Through Financial Inclusion

Despite the favourable working conditions in the apparel industry, most female workers keep away from the formal banking system. The financing that is available, if any, came from informal channels at exorbitant cost. As such, financing even a small domestic or personal issue becomes a burning problem for these female workers.

The Bank stepped in with a microfinancing scheme after conducting a socio-demographic study. Two broad investment purposes were identified: (i) consumption/home improvement (such as upgrading sanitary facilities); and (ii) income generation (such as domestic manufacturing or trading).

The loans are LKR 150,000 each with 3-year tenors and are backed by mutual or cross guarantees by fellow borrowers. Thus far, a total of 12 loans for consumption and 10 for income generation purposes have been disbursed, while a long pipeline of applications are being processed.

Targeting the female apparel worker in this programme has brought about a paradigm change in their lives, such as improved living standards, financial empowerment and greater social acceptance. This will, over time, snowball to the entire local community through new-found financial capabilities.

Supporting Community-Based Agribusiness

The Bank spearheaded the formation of a community group at Siriketha village in the Hingurakgoda Divisional Secretariat. Over 80 village floriculture farmers are part of this group, and through financial empowerment have become independent of intermediaries and are gaining access to new markets.

In a similar initiative, the Bank teamed up with the Export Development Board and ‘Suwahas Mal Society’ to provide financial and technical assistance to several small-scale floriculturists in the Gampaha and Kandy Districts.

Promoting Entrepreneurship

The Bank partnered with the Industrial Development Board (IDB) to assist in building entrepreneurs trained by the IDB in their Colombo District office. Several workshops and credit camps were conducted for these IDB trainees on a variety of topics such as financial management.

Trade Finance

To ensure service excellence the Bank's Trade Finance Department is ISO 9001 2008 certified. To promote Trade Finance activity a new unit was established in the Pettah branch, the hub for trade and results revealed encouraging signs. Products offered under this segment are well complimented by the Bank's worldwide correspondent banking network including Development Finance agencies such as International Finance Corporation Asian Development Bank.

Trade Finance Department also conducted training and awareness programmes across the country for staff and for the Bank's customers taking the subject of Trade and related Banking products to the doorstep of customers in the Regions. It is envisaged that this activity will encourage and support new business from the SME sector.

Please refer the Recognition Section read on the award won by the Trade Finance Department in 2015.

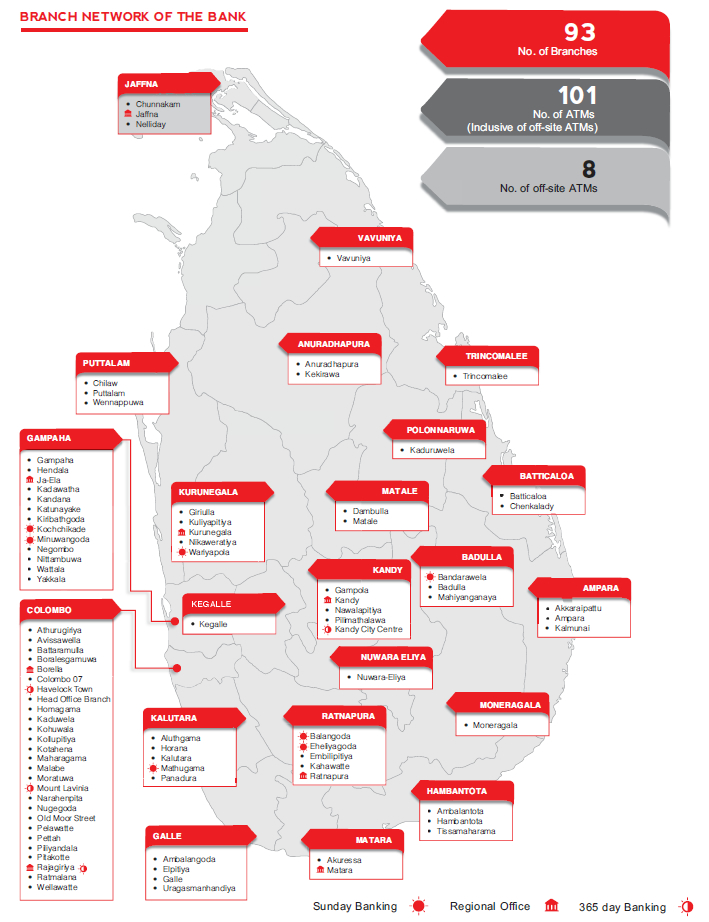

Delivery Channels

Our delivery channels include 93 branches, all LANKAPAY enabled ATMs around the country and VISA enabled ATMs around the globe. In addition customers have access through the Internet and card-based systems.

Branches

Going beyond the over banked urban and suburban markets, the Bank also set up branches in rural and developing towns during the year. These branches are strategic investments that will reap the benefits of growth of these markets.

Alternate Channels

With the technological and social revolution taking place in the e-banking environment, we set in motion, the strategies aimed at accelerating acquisition and delivery of e-based touch points. We see that the future growth of retail banking would be through alternate channels more than through traditional brick and mortar channels.

ATM Network

- In addition to ATMs throughout our branch network we improved our off-site ATM installations through selected strategic partners, thus further enhancing accessibility for many to experience the presence of the Bank.

- Number of on-site ATMs: 10 established during the year, total 93.

- Number of off-site ATMs: 8 established during the year, total 8.

New Branches Opened During the Year

| Branch Name | District | Province |

| Battaramulla | Colombo | Western Province |

| Giriulla | Kurunegala | North-Western Province |

| Hendala | Gampaha | Western Province |

| Kahawatta | Ratnapura | Sabaragamuwa Province |

| Kekirawa | Anuradhapura | North-Central Province |

| Kochchikade | Gampaha | Western Province |

| Pitakotte | Colombo | Western Province |

| Chenkalady | Batticaloa | Eastern Province |

| Akkaraipattu | Ampara | Eastern Province |

| Thissamaharama | Hambantota | Southern Province |

Redefining Our Online Presence

As a part of the Bank’s continued efforts to make the NDB brand more relevant in emerging market segments, we continued to strengthen our online presence via the corporate website and social media engagements.

The Bank received awards for the second consecutive year for the ‘Best use of Facebook’ and the ‘Best use of Social Networks’ at the 6th CMO Asia Awards for Excellence in Branding and Marketing held in Singapore. The NDB Facebook page counts 297,000 fans, an increase of 179,000 over 2014. The page continues to build high interactivity by hosting many campaigns and games. Noteworthy campaigns during the year include Mother’s Day, Father’s Day and Earth Hour. The online ‘Ice Cream Dansala’ conducted on the page was an innovative initiative to spread the Vesak atmosphere, with vouchers to purchase ice cream sent to those who participated. Fans were delighted and responded well.

The Bank’s ‘Shilpa’ page is in addition to the Bank’s corporate page and is aimed at educating parents, parents to be and young adults on the savings habit for children and general tips on upbringing children. The Shilpa Facebook page maintains a fan base close to 50,000.

The Bank expanded its social media presence through Twitter and recorded a 244% growth in terms of followers during the year. Updates on Bank events, products, insights from customer forums, notices and daily inspirational retweetable quotes were shared. These tweets received good impressions and interactions.

The Bank’s LinkedIn page has an increasing base of followers. It is ranked at 2nd place in Sri Lanka’s financial services industry in terms of number of followers, with Vacancy Announcements being the most popular. Corporate details, events and announcements along with other useful business and motivational articles for professionals are also posted on the page. Sharing valuable career and personal advice extracted from internal training programmes is the latest addition to our LinkedIn page.

Website

Our corporate website is a one stop hub to collect information on all aspects of the Bank. We are in the process of revamping the website, which will be available in the near future.

Youtube

The NDB Youtube channel contains all videos published by the Bank, and includes corporate announcements, media briefings, events and commercials.

NDB Digital

In addition to the corporate website, the Bank needed a soft push to showcase its products without having to ‘sell’ them. A website akin to a blog was thus developed to address areas such as home loans, vehicle leasing, children’s saving, general savings, credit cards and investments. Under the separate categories of Cards & Offers, Home & You, Goals & Plans, Save & Invest, Wheels & Dreams, Kids & Money this website accumulates articles that are archived monthly. The objective of the blog site is to appear on related Google searches.

‘Opt in’ Newsletter

An ‘opt in’ Newsletter was initiated to share the contents of the digital site with interested recipients. This bi-monthly Newsletter consists of four main articles and four more of relevance. Ongoing promotional campaigns are also shared on the newsletter.

Product Responsibility

Responsible Lending

Project and infrastructure financing is an area for possible indirect risks for the Bank if not carefully managed. This could arise from the manner in which the project is implemented as well as from the sale, use and disposal of the products or services generated by the project.

Environmental and Social Management System

With over 30 years of term lending experience coupled with a continuous upgrading of skills and knowledge, the Bank’s lending officers go beyond the norm, sharing their expertise and knowledge with their customers and guiding them on project-related aspects. This includes environmental and social safeguards through its Board approved Environmental and Social Management System (ESMS) which is aligned with national requirements as well as those of international lending institutions. The ESMS is an integral part of the Bank’s Credit Policy for term lending.

ESMS requires the Bank to screen projects to be funded from the initial stage of evaluation to identify probable environmental and social issues and to avoid or mitigate them. Issues identified are discussed with the project promoter and mechanisms are formulated jointly to ensure buy in. Such mechanisms are then formalised through loan covenants – including pre-disbursement conditions – which are legally binding.

Product and Service Labelling

The Bank takes utmost care in facilitating accurate and relevant information about its products and services to its customers. The Bank’s website, its 24 hour service hotline and other forms of printed material are sources of detailed and easily accessible information presented in a manner that is easily understood by all.

The Bank adheres to all statutory requirements for its products and services. There were no incidents of non-compliance in this regard.

Creating a Socially and Environmentally Responsible Customer

The ESMS may require community consultations and impact assessments, with the depth of study depending on the nature of the project.

The Bank maintains a list of activities that are excluded for funding. Compliance is monitored on several fronts. A five-member cross functional team is responsible for the day-to-day operations of ESMS. The team includes an Environmental and Social Coordinator and a Technical Champion, both having received training in these fields. In addition, relationship managers in relevant departments, who have been trained in the day-to-day operation of the ESMS, follow up on the client’s environmental licences annually and visit project sites at least once in every two years for monitoring.

Our lending policies thus also inculcate sound management practices on environmental and social aspects in client companies.

Responsible Practices

Going beyond the ESMS, we integrate the concept of value creation and sustainability into all our business processes. These in turn impact on our customers, business partners and the whole value chain. For example, we encourage the use of technology to minimize resource consumption without compromising on service standards, promote energy efficient and renewable energy-based processes, products and services, maintain a supplier policy that includes adherence to labour laws, decent work, fair trade and so on.

Responsible Product Development

Switching to Renewable Energy

We encourage the use of renewable energy for households with high electricity consumption. Our NDB Solar Vantage is a personal loan for financing solar photovoltaic (PV) energy systems for domestic usage. The Bank partners with the Sustainable Energy Authority of Sri Lanka (SEASL) in this programme that ensures reliability of service and product quality. The loan scheme includes a special interest rate and tenors up to five years. It is customised and structured to ensure acceptable payback with savings on monthly electricity bill payments through the net metering mechanism.

Building a Nation of ‘Savers’

The Bank offers a diverse range of savings products targeting salaried people, the general public and children.

Amongst them are ‘NDB Real Saver’ for the individuals who strive to make regular savings a habit, even in small quantities, ‘NDB Salary Max’ current/savings account, specially designed for salaried individuals to facilitate mandatory savings and ‘NDB Shilpa’ children’s savings account.

Communication Policy

The Bank’s Communication Policy aims to encourage effective internal and external communications of corporate information in relation to the Bank on its behalf covering all stakeholders including staff, customers, creditors, shareholders, partners, general public and regulators. The overall goal is to demonstrate to the stakeholders and the general public, the range of products and services offered by the Bank as a universal Bank, and to create and enhance visibility of the NDB Brand. Beyond awareness, effective communication would contribute towards achieving the business strategies of the Bank. As a regulated public quoted bank, the Bank shall strive to ensure that communication is transparent whilst taking into account the laws relating to secrecy and confidentiality. The key focus of internal communication is to support the Bank in achieving its business objectives and strategy. Further, internal communication also assists in building an organization culture and feeling of commitment and unity among its staff.

Customer Privacy

The Bank maintains an online complaint management system where complaints are resolved within a specific time frame taking into account the nature and complexity of the complaint. Once a complaint is lodged, it is escalated to the relevant head of department. There were no substantiated complaints regarding breaches of customer privacy or loss of customer data during the year.

The Bank adheres to a strict secrecy policy to which all staff members are bound through the Code of Conduct. Further, the information technology platform of the Bank is under strict confidentiality and is duly secured against malicious spyware etc.

No incidents were reported regarding non-compliance with regulations and voluntary code concerning communication policy during 2015.