Management Discussion and Analysis

and Investor Capital Formation

We are committed to generate Superior shareholder Returns at all times

Investor Capital

The Bank’s investors both institutional and individual, provide financial capital with the expectation of a return. The financial capital may be either equity or debt, with the expected return covering a combination of short, medium and long-term. The investors are of value to the Bank, and through the interaction of various forms of financial and non-financial capital the Bank derives future earnings to derive value for itself and for its stakeholders.

Investor Relations

Shareholder Profile

As detailed under Investor Relations, 77.6% of the Bank’s share capital is held by institutions, accounting for 5.5% of the Bank’s 7,911 shareholder base. Residents, both institutional and individual, hold 69.1% of the shares in issue and account for 98.1% of shareholders.

Engagement

Satisfying this diverse mix of investors and their expectations, is a strategic management responsibility that integrates finance, communications, marketing and compliance. This facilitates an effective two-way communication between the Bank, investors and other constituencies (see Stakeholder Engagement). Such engagements enable the Bank to obtain a fair value for the securities and help the investors to make informed trading decisions. In addition, it also provides market intelligence to the Bank’s corporate management. Our engagement is extended to other connected stakeholders such as analysts, media and regulatory authorities. We believe that well-informed market participants are important for the efficient functioning of the capital markets and the stability of the financial system as a whole.

Share Price Movement

The Bank's share price closed at LKR 194.10 on 31 December 2015. The highest share price of LKR 280 was reached on 22 May and 23 July 2015. The total market capitalization of the share was ranked 21st on the

Colombo Stock Exchange (2014: ranked 16th).More information is given under Investor Relations.

Return to Shareholders

The Group Earnings per Share (EPS) for the year ended 31 December 2015, was LKR 21.51, whilst Return on Equity (ROE) was 12.59%. The resultant Price Earning (PE) Ratio was 9.02 times as at 31 December 2015. More details are given under Investor Relations.

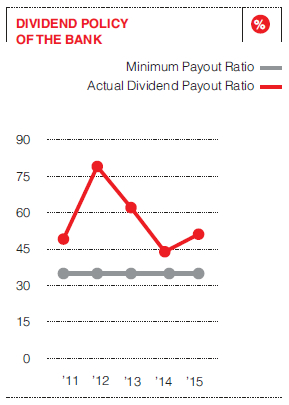

Dividend Policy

The Bank strives to deliver consistent and higher returns to shareholders through profitable performance. The policy specifies that there should be a gradual increase in dividends in tandem with profit growth, whilst taking into account, inflation and future cash needs for sustainable operations. The latter requires striking a balance between a healthy payout with prudent ratios, as specified below:

| Ratio | Policy guideline |

Actual 2015 |

| Dividend payout ratio | >35% | 51% |

| Capital adequacy | >12% | 12.59% |

| Open loan position | <40% | 9.64% |

| Liquidity | >20% | 22.24% |