Management Discussion and Analysis

and Employee Capital Formation

The bank draws on its diverse workforce as inherent strengths to deliver big results

1960, people worked at the Bank by the end of 2015, and women formed over one-third of this workforce.

‘Our commitment, your success’ – delivered by a best in class, engaged and inspired team. It’s all about how the Bank builds its employee capital by attracting the best of talent, nurturing and moulding their development and rewarding performance.

Staff Strength

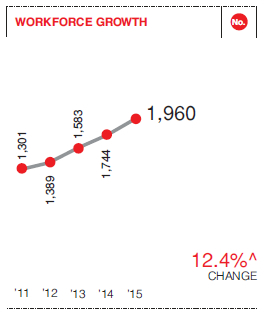

By the end 2015, 1,960 people worked at the Bank, an increase of 12.4% over the previous year’s total of 1,744 persons. Women form well over one-third of our workforce, including senior management grades; while the NDB Bank family is proud to say that it comprises people from diverse social backgrounds, ethnicities, religions and ages. The Bank draws on this diversity as inherent strengths to deliver big results.

Workforce by Grade and Gender

| Number | Composition, % | ||||

| Grade | Male | Female | Total | Male | Female |

| Senior management | 29 | 17 | 46 | 63 | 37 |

| Management | 141 | 75 | 216 | 65 | 35 |

| Executive | 221 | 86 | 307 | 72 | 28 |

| Non-executive | 567 | 480 | 1,047 | 54 | 46 |

| Specialized sales force | 208 | 20 | 228 | 91 | 09 |

| Trainees and others | 59 | 57 | 116 | 51 | 49 |

| Total | 1,225 | 735 | 1,960 | 63 | 37 |

Workforce by Employment Type and Gender

| Number | Composition, % | ||||

| Employment type | Male | Female | Total | Male | Female |

| Permanent | 906 | 585 | 1,491 | 61 | 39 |

| Contract | 64 | 77 | 141 | 45 | 55 |

| Specialized salesforce | 208 | 20 | 228 | 91 | 09 |

| Trainee banking assistants | 37 | 46 | 83 | 45 | 55 |

| Interns | 10 | 07 | 17 | 59 | 41 |

| Total | 1,225 | 735 | 1,960 | 63 | 37 |

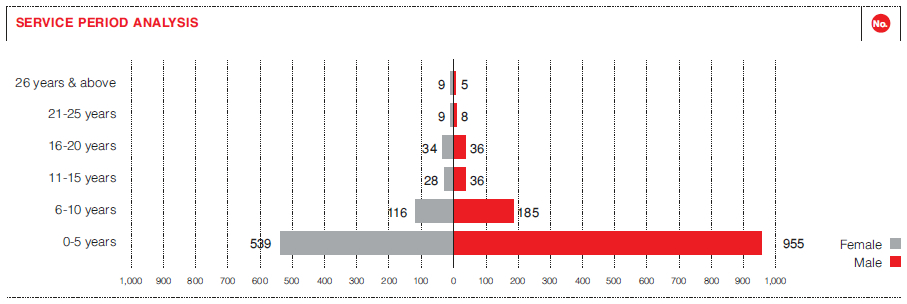

Employees in the permanent cadre accounted for 76% of the total workforce by end 2015 (2014: 79%, 2013: 82%). In order to optimize business efficiencies certain tasks are outsourced. Contract cadre employees are mainly engaged in incentivized jobs such as the Specialized Sales Force and school leavers awaiting their GCE Advanced Level Examination results who may move on with easy exits.

Workforce Growth

Workforce by Location and Gender

| Number | Composition, % | ||||

| Location | Male | Female | Total | Male | Female |

| Head Office – Colombo | 598 | 434 | 1,032 | 58 | 42 |

| Region 1 – Colombo | 95 | 63 | 158 | 60 | 40 |

| Region 2 – Greater Colombo | 82 | 53 | 135 | 61 | 39 |

| Region 3 – Southern | 85 | 27 | 112 | 76 | 24 |

| Region 4 – North Western | 92 | 56 | 148 | 62 | 38 |

| Region 5 – North Central | 76 | 24 | 100 | 76 | 24 |

| Region 6 – Central | 81 | 42 | 123 | 66 | 34 |

| Region 7 – Uva-Sabaragamuwa | 62 | 16 | 78 | 79 | 21 |

| Region 8 – North Eastern | 54 | 20 | 74 | 73 | 27 |

| Total | 1,225 | 735 | 1,960 | 63 | 37 |

Recruitment and Retention

As the impending merger with DFCC Bank did not progress, our focus was on fostering organic growth, supported by internal promotions and succession planning. The Bank also welcomes new thinking that comes with new blood. A transparent procedure is in place for all staff recruitment, which is followed by induction and absorption. As an employer of choice, the Bank adopts some of the best industry practices in retaining staff. In addition to providing an attractive remuneration package, other aspects focused on retention include regular employee engagement, training and development, career progression, equal opportunity, parental leave, employee share options, an Equity Linked Compensation Plan and retirement benefits.

Recruitment

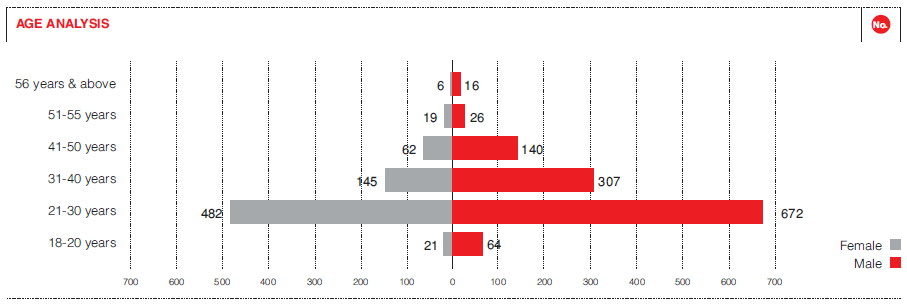

To keep pace with our planned growth the Bank recruited a total of 457 persons (2014: 379 persons) during the year. Males (67%) and the age groups 18 to 20 years (21%) and 21 to 30 years (66%) accounted for the largest proportion of new entrants. Out of the total, 57% were posted at the Head Office, with all eight Regions absorbing the rest (4% to 8%).

In filling most vacant positions in the organization, HR adopted a bottom-up approach, where the positions are filled by suitable internal staff, following an internal selection process. In this manner, pools of staff are built at various levels to step up to internal vacancies and where necessary only, prospective candidates are recruited externally.

In recruiting candidates externally, the Bank adopts many methods. Recruitment drives are conducted in academic bodies, such as universities and main professional bodies in Sri Lanka. The Bank has come into an understanding with universities to recruit newly passed out graduates of certain disciplines. Further, recruitment drives are conducted in order to recruit Y generation youngsters, who are incentivised contract staff of the Bank. These drives which use state-of-the-art assessment methods, are enriched by giving a unique experience to the participants.

Employee Turnover

A total of 116 employees resigned from the Bank during the year, with males (65%) and the age group 20 to 30 years (47%) accounting for the largest proportion of leavers.

The overall employee attrition rate during the year, measured as the percentage of employees leaving the Bank (excluding those retiring) divided by the average number employed during the year amounted to 7.75% (2014: 6.58%). The attritions were mainly due to job opportunities both locally and overseas, migration and personal reasons.

Turnover by Age Group

| 2015 | 2014 | |||

| Age Group | No. Leaving |

Attrition % |

No. Leaving |

Attrition % |

| 18 - 20 years | – | – | – | – |

| 21 - 30 years | 55 | 7 | 52 | 7 |

| 31 - 40 years | 48 | 11 | 29 | 8 |

| 41 - 50 years | 11 | 5 | 10 | 5 |

| 51 - 55 years | 01 | 2 | – | – |

| Over 55 years | 01 | 14 | – | – |

| Total | 116 | 8 | 91 | 7 |

Turnover by Location

| 2015 | 2014 | |||

| Location | No. Leaving |

Attrition % |

No. Leaving |

Attrition % |

| Head Office – Colombo | 59 | 8 | 54 | 8 |

| Region 1 – Colombo | 17 | 13 | 10 | 9 |

| Region 2 – Greater Colombo | 08 | 7 | 05 | 5 |

| Region 3 – Southern | 06 | 7 | 04 | 4 |

| Region 4 – North Western | 08 | 7 | 10 | 9 |

| Region 5 – North Central | 02 | 3 | 01 | 2 |

| Region 6 – Central | 04 | 4 | 03 | 4 |

| Region 7 – Uva - Sabaragamuwa | 04 | 6 | 03 | 6 |

| Region 8 – North Eastern | 08 | 14 | 01 | 2 |

| Total | 116 | 8 | 91 | 7 |

Parental Leave

Only female employees are entitled to parental (maternity) leave, and hence male employees are excluded in computing the return to work and retention rate statistics given below:

- Return to work: Employees returning to work after maternity leave out of those due to return in 2015 was 77% (2014: 95%)

Defined Employee Benefit Plans

Employees of the Bank are entitled to a gratuity payment on resignation after having served a period of five years at the Bank. Whilst the Bank does not provide for a pension plan, a small proportion of employees who were employed by the National Development Bank remain eligible to a non-contributable private pension plan.

Employees are eligible for Employees’ Provident Fund (EPF) contributions (10% by employee, 15% by Bank), and Employees’ Trust Fund (ETF) contributions (3% by Bank) in accordance with the respective statutes and regulations. Senior management staff may also participate in an Equity Linked Compensation Plan subject to certain limits, terms and conditions.

Details of the above plans and professional actuarial valuations for Employee Benefit Liabilities are given in Note 40 to the Financial Statements.

Benefits to Full-Time Employees

The table below summarizes the benefits available to full-time employees, who may be either permanent employees or contract employees.

| Type of Benefit | Permanent Employees | Contract Employees |

| Compensation | ||

| Fixed compensation | Applicable | Applicable |

| Variable compensation | Applicable | Applicable |

| Long-term share based schemes | Applicable | Not applicable |

| Other perquisites | ||

| Subsidized loans | Applicable | Not applicable |

| Retirement benefits | Applicable | Applicable |

| Reimbursable expenses | Applicable | Not applicable |

| Other benefits | Applicable | Applicable |

Training and Development

The training and development philosophy at the Bank recognizes that it is employees who drive the business. The Bank invests in their continuous learning through programmes that are geared towards identifying, developing and retaining talent whilst catering to the business needs and long-term goals of the Bank. Training needs are identified through staff performance reviews, assessment feedback and regular discussions with line managers. Training programmes are prioritized depending on operational urgencies and discussions with line management to identify and close competency gaps.

The Bank maintains arrangements with professional bodies such as the Institute of Bankers, Sri Lanka (IBSL), Centre for Banking Studies (CBS) and Chartered Institute of Management Accountants (CIMA) Sri Lanka who organize regular training sessions for staff. The IBSL facilitates in-house Diploma and Certificate courses to employees that lead to professional banking qualifications such as Diploma in Credit Management and Certificate in Branch Banking Operations. The programmes are both off-the-shelf as well as customized to meet specific requirements of the Bank.

As part of the Bank’s welfare initiatives, the Bank provides a range of training and assistance that supports lifelong learning and transition support. The following programmes were conducted in 2015; Effective Communication Skills Programme, Business Writing Skills Workshop, Communication Skills Development Programme, Workshop on ‘Personal Grooming and Social Etiquette’, Career Women Programme, Training on MS office Excel 2010, and programmes on Time Management. These programmes develop knowledge, competencies and learning that collectively benefit our employees.employees are also sent overseas for specialized training, and the Bank maintains affiliations with foreign training bodies such as Euromoney, Marcus Evans, CRISIL (India) and Singapore Institute of Management.

During the year, the Bank invested LKR 55 million (2014: LKR 38 million) to provide a total of 69,137 person hours of training (2014: 101,076 person hours) across all categories of staff. The Bank made a concentrated effort on specialized foreign training in 2015.

Average Training Hours

Training is made available to staff based on needs, both in terms of the Bank and the individual and is independent of gender. The average duration of formal training provided during 2015 was 32.4 hours per person overall (2014: 59.04 hours per person). By gender, the corresponding figures were 30.24 hours per female (2014: 59.37 hours) and 33.39 hours per male (2014: 50.17 hours) employee.

| Gender | Average Training hours |

| VP | 26.3 |

| AVP | 37.43 |

| Senior Management staff Total | 63.73 |

| Chief Manager | 33.2 |

| Senior Manager | 21.8 |

| Manager | 18.77 |

| Management staff Total | 73.77 |

| Deputy Manager | 19.3 |

| Associate Manager | 21.01 |

| Executive | 30.0 |

| Executive Staff Total | 70.31 |

| Junior Executive | 26.93 |

| Senior Banking Associate | 19.77 |

| Banking Associate | 35.22 |

| Non-Executive staff | 81.92 |

Self-Learning

Employees are encouraged to supplement Bank-provided external training with self-learning and take control of their professional development. The Bank supports this through the investment in e-learning, which now has 34 modules. In addition, employees may enrol on other part time courses offered by universities and professional bodies to further their development.

As another facet of personal development, the Bank initiated the NDB Toastmasters Club in 2013 and joined the Global Toastmasters fraternity. This has helped many to improve their oral communications while giving them confidence to participate in professional forums.

Diversity and Equal Opportunity

As an equal opportunity employer the Bank recognizes that diversity in terms of ethnicity, gender, race, religion and age serve to strengthen the collective human talent of the Bank. While they serve to enrich the human capital, diversity arising from hiring locally helps the Bank to better align its business model to effectively meet the needs of local communities.

Composition of Governance Bodies

Rewarding Performance

The Bank rewards employees based on performance with absolutely no bias based on gender or any other divisive factor. A new Performance Development System (PDS) with improved performance measurement metrics, objectivity and transparency was launched in 2013 and further refined during 2014 to enhance uniformity and consistency.

As per the reward mechanism 82% of staff became eligible for performance bonus during 2015. In a further effort to differentiate excellence, a special merit bonus scheme was introduced in 2014 and was implemented in 2015 in a transparent manner.

Performance Reviews

Individual performance is assessed through a formal appraisal process against agreed objectives and targets, and is benchmarked against industry norms. All employees, irrespective of grade, are subject to this review process. The review process entails a mid-year review and a final review at the end of the performance cycle.

Gender Equity

The performance review and remuneration mechanism at the Bank recognizes and rewards individuals according to their performance. Hence, there is no gender bias.

The ratio of the weighted average basic salary by gender, female:male, for the Bank overall during the year was 1:1.1, which is the same as in the previous year.

Average Basic Salary Ratio, Female to Male, Analyzed by Grade

| Grade | Female | Male |

| Senior management | 1 | 1.3 |

| Management | 1 | 0.9 |

| Executive | 1 | 1.0 |

| Non-executive | 1 | 1.0 |

| Specialized sales force | 1 | 1.0 |

| Others | 1 | 2.1 |

| Overall for the Bank | 1 | 1.1 |

Average Basic Salary Ratio, Female to Male, Analyzed by Location

Collective Bargaining

Although the Bank does not have a formal collective bargaining process, it encourages an open door policy and has in place many mechanisms to encourage employees to discuss their grievances.

Also the Bank provides to the employees a substantial notice period, prior to major operational changes that could affect them.

Human Rights

We believe in the dignity of every human being and respect individual rights as set forth in the UN Global Compact (UNGC) concerning human rights, labour, the environment and anti-corruption principles. The Bank adheres to these principles.

There were no incidents of any form of discrimination reported during the year.

Likewise, there were no incidents of child labour, forced and compulsory labour reported during the year.

Occupational Health and Safety

The Bank recognizes the importance of providing a healthy work environment as well as the need to balance one’s demands of work and family. Accordingly, Corporate Wellness Programmes are conducted from time to time while Corporate Fitness Centre facilities are offered to all employees. In addition, the Bank maintains officers trained in first aid and psychological assistance who are available at all times to assist staff while on duty.

During the year 01 incident related to occupational health and safety was reported (2014: 3) and duly addressed. The total number of days lost in relation to these incidents was 24 person days (2014: 146 person days).

Employee Engagement

The Bank uses several channels to engage with staff. Regular dialogue clears misconceptions, enhances transparency and builds trust. They also serve to inform, listen to opinions, ideas and grievances, and above all they underscore one’s sense of belonging to the NDB family.

Driving Excellence

The Bank's internal human resource strategies are based on four pillars:

- being an employer of choice

- creating value through skills and adequate compensation

- continuous engagement with employees

- achieving operational excellence in serving employees.

These are aimed at driving and supporting superior employee performance that complement the Bank's seven pillars of business strategy.

Welcoming Feedback

The Bank conducts two Employee Satisfaction Climate Surveys each year. The survey seeks to obtain information on the services provided by the Human Resources Department of the Bank and identify ways in which processes may be strengthened in accordance with the four pillar strategy described above.

All employees are entitled to raise a grievance in relation to their employment at the Bank within 30 days of the occurrence of a given event. It may be raised through informal or formal channels. The communication channels would include weekly meetings held by the Leadership Team, Branch Managers meetings, Regional Manager Conferences and Quarterly Town Hall meetings held for the executive cadre. It is also possible for a grievance to be directly referred to the CEO.

A total number of 3 grievances were addressed and resolved over the year.

All Aboard

Taking a broader view that goes beyond 'work', the Bank believes that the emotional engagement of staff is also important for a long-lasting relationship. This takes several forms. Some activities extend to the families of employees, such as the felicitation of children of staff who excel at public examinations and workshops during school holidays with a focus on arts/crafts and leadership skills.

Through the Recreation Club of the Bank it encourages employees to participate in sports. The Bank participated in many sports in mercantile tournaments and excelled in Basketball, Netball and Athletics where teams won places at tournaments and individual athletes excelled with Gold, Silver and Bronze medals.

Promoting employee volunteerism received special attention during the year, where NDB undertook a tree planing programme of 2000 areas along the Deduru Oya reservoir in its quest to sustain a greener environment. The focus is on encouraging direct employee participation through teams to supplement the Bank’s own CSR initiatives. Under this programme the Bank provides a financial allocation to each CSR team to implement its own CSR project in the areas of education, entrepreneurship, health and children. The programme has triggered much enthusiasm across the Bank and has contributed to a better understanding of social issues, empathy and teamwork amongst employees.

NDB Toastmasters Club

NDB Toastmasters Club completed a very successful year in 2015, being a very young club that was chartered in October 2013.

The Club achieved many awards during the year, including three International Awards. The Club also achieved the President’s distinguished status which is the highest level of recognition a club can achieve in global Toastmasters fraternity having met the membership prerequisite and achieving all 10 goals set by Toastmasters International Headquarters - California, USA.

In addition to the regular fortnightly educational meetings, the Club conducted several programmes for the benefit of the Bank’s staff members as well as their children. NDB Best Speaker Contest was conducted for the 2nd consecutive year in 2015 with great enthusiasm. The event saw the participation of employees representing a large number of departments and branches.

The training Programme ‘Back to the Stage’ was conducted to improve the public speaking and leadership skills of the children of the NDB Staff. Furthermore, the club organized three Regional Training Programmes in Central Region (Kandy), Southern Region (Matara) and Sabaragamuwa Region (Ratnapura) for the benefit of the Bank’s regional staff members.

NDB Toastmasters Club has passed through three themes since its inception, ‘Breaking Through’ (2013/2014), ‘Discovering The Potential’ (2014/2015) and ‘Quality With Spirit’ (2015/2016) , which has escalated the Club’s quality and caliber to internationally recognized levels.